The Bullwhip Effect

Causes. Countermeasures.last updated Wednesday, November 19, 2025

#Bullwhip Effect #

| | by John Burson |

QUICK LINKS

AD

Get access to EB 5 Visa Investment Projects

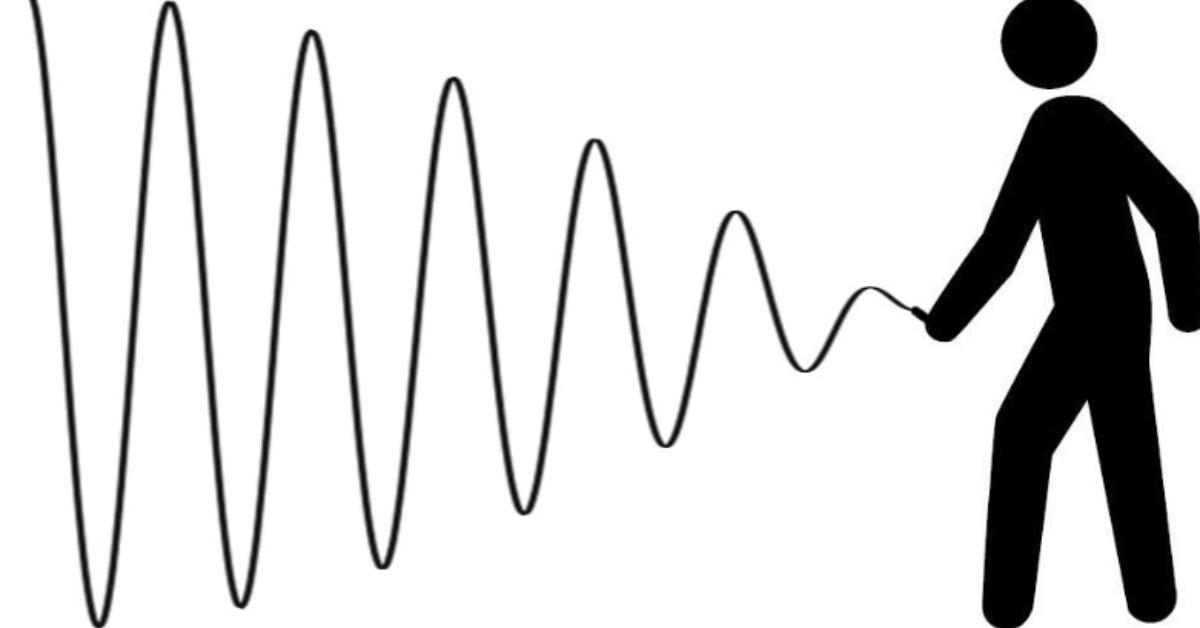

An unmanaged supply chain is not inherently stable. Demand variability increases as one moves up the supply chain away from the retail customer, and small changes in consumer demand can result in large variations in orders placed upstream. Eventually, the network can oscillate in very large swings as each organization in the supply chain seeks to solve the problem from its own perspective. This phenomenon, known as the bullwhip effect, has been observed across most industries, resulting in higher costs and poorer service.

Causes of the Bullwhip Effect

Sources of variability can be demand variability, quality problems, strikes, plant fires, etc. Variability, coupled with time delays in the transmission of information up the supply chain and in manufacturing and shipping goods down the supply chain, creates the bullwhip effect. The following can all contribute to the bullwhip effect:

-

Overreaction to backlogs

-

Neglecting to order in an attempt to reduce inventory

-

No communication up and down the supply chain

-

No coordination up and down the supply chain

-

Delay times for information and material flow

-

Order batching: larger orders result in greater variance. Order batching occurs to reduce ordering costs, take advantage of transportation economics such as full-truckload economics, and benefit from sales incentives. Promotions often lead to forward buying to benefit from lower prices.

-

Shortage gaming: customers order more than they need during a period of short supply, hoping that the partial shipments they receive will be sufficient.

-

Demand forecast inaccuracies: everybody in the chain adds a certain percentage to the demand estimates. The result is a lack of visibility into true customer demand.

-

Free return policies

Countermeasures to the Bullwhip Effect

While the bullwhip effect is a common problem, many leading companies have implemented countermeasures to overcome it. Here are some of these solutions:

-

Countermeasures to order batching - High order costs are addressed through Electronic Data Interchange (EDI) and computer-aided ordering (CAO). Full truckload economics are countered with third-party logistics and assorted truckloads. Random or correlated ordering is countered with regular delivery appointments. More frequent ordering results in smaller orders and smaller variance. However, when an entity orders more frequently, it will not see a reduction in its own demand variance; the reduction is seen by upstream entities. Also, when an entity orders more frequently, its required safety stock may increase or decrease; see the standard loss function in the Inventory Management section.

-

Countermeasures to shortage gaming - Proportional rationing schemes are countered by allocating units based on past sales. Ignorance of supply chain conditions can be addressed by sharing capacity and supply information. Unrestricted ordering capability can be addressed by reducing the flexibility of order size and implementing capacity reservations. For example, one can reserve a fixed quantity for a given year and specify the quantity of each order shortly before it is needed, as long as the sum of the order quantities equals to the reserved quantity.

-

Countermeasures to fluctuating prices - High-low pricing can be replaced with everyday low prices (EDLP). Special purchase contracts can be implemented to specify ordering at regular intervals to better synchronize deliveries and purchases.

-

Countermeasures to demand forecast inaccuracies - Lack of demand visibility can be addressed by providing access to point of sale (POS) data. Single control of replenishment or Vendor-Managed Inventory (VMI) can mitigate exaggerated demand forecasts. Long lead times should be reduced where economically advantageous.

-

Free return policies are not easy to address. Often, such policies simply must be prohibited or limited.

Free Consultation

Search within Paperfree.com