Sustainable Infrastructure Funds: Top Opportunities for Diversification

Top Sustainable Infrastructure Funds and Managers to Consider in 2026last updated Wednesday, December 17, 2025

#sustainable infrastructure fund #funding sources for sustainable urban infrastructure

| | by John Burson | Content Manager, Paperfree Magazine |

QUICK LINKS

AD

Get Access to Real Estate Investment Opportunities

As investors look toward 2026, sustainable infrastructure funds are emerging as a standout alternative investment class. These funds focus on projects that deliver essential services while prioritizing environmental resilience, social impact, and long-term economic stability—such as renewable energy, efficient water systems, green transport, and climate-adaptive buildings.

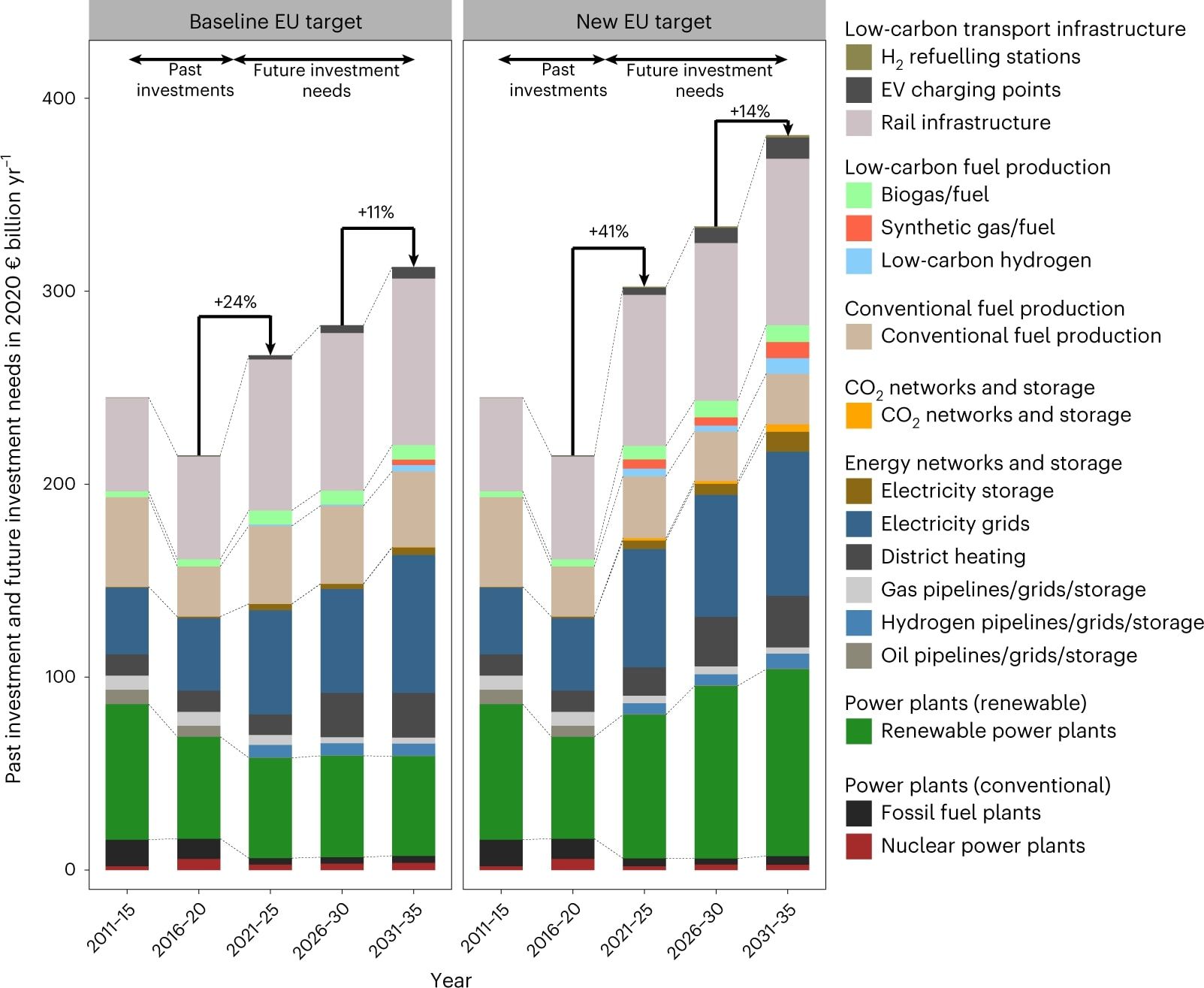

With global infrastructure needs estimated at trillions annually and a persistent investment gap of around $6.9 trillion per year, sustainable options are gaining momentum. Morningstar highlights soaring renewables investment and grid upgrades as key trends for 2026, driven by energy transition demands and data center growth. Private markets are playing a larger role, offering investors stable, inflation-protected returns often uncorrelated with traditional stocks and bonds.

Why Sustainable Infrastructure Funds Are Ideal for 2026 Diversification

Alternative investments like sustainable infrastructure provide defensive qualities amid potential volatility. BlackRock and Brookfield emphasize decarbonization, digitalization, and deglobalization as mega-forces accelerating demand for resilient assets. These funds typically target 8-12% annual returns through steady cash flows from long-term contracts, such as power purchase agreements or government-backed projects.

Key drivers for 2026

Renewables boom

Global investment in clean energy continues to soar, with private equity targeting wind, solar, and energy storage.

Grid and critical minerals

Investments in transmission infrastructure lag renewables deployment, creating opportunities.

Policy support

Despite shifts, frameworks like FAST-Infra Label standardize sustainability metrics, boosting investor confidence.

Outperformance potential

Sustainable assets can outperform conventional infrastructure by over 20% in net-zero scenarios.

For platforms like Paperfree, which specialize in real estate and private equity alternatives, sustainable infrastructure aligns perfectly with EB-5 projects in green developments or renewable-focused funds.

Top Sustainable Infrastructure Funds and Managers to Consider in 2026

Here are the leading options based on current trends, fundraising success, and focus on sustainability:

1. Copenhagen Infrastructure Partners (CIP)

World's largest dedicated greenfield renewables manager, with €35 billion AUM. Focuses on offshore wind, solar, and energy storage in high-growth markets.

2. Brookfield Global Renewables & Sustainable Infrastructure Fund

Targets next-generation opportunities in renewables, storage, and transition assets. Brookfield's infrastructure platform emphasizes decarbonization.

3. J.P. Morgan Sustainable Infrastructure Fund

Invests in equities promoting sustainable economy infrastructure, including REITs, with AI-driven insights.

4. North Sky Capital Sustainable Infrastructure Funds

Focuses on renewable power, energy storage, efficiency, water, and waste projects for attractive returns and environmental impact.

5. BlackRock or Macquarie-led funds

Often tops the Infrastructure Investor 100 for large-scale sustainable projects.

For accessible options:

iShares Global Clean Energy ETF (ICLN): Broad exposure to renewables.

Global X CleanTech ETF (CTEC): Targets innovative green technologies.

Comparison of Leading Sustainable Infrastructure Funds

| Fund/Manager | Focus Areas | Expected Returns | Key Advantage |

|---|---|---|---|

| Copenhagen Infrastructure Partners | Greenfield renewables, energy transition | 10-15% IRR | Largest dedicated greenfield player |

| Brookfield Renewables & Sustainable | Renewables, storage, infrastructure | 8-12% | Mega-force alignment (decarbonization) |

| J.P. Morgan Sustainable Infrastructure | Equities in sustainable assets | 8-10% | Data/AI-driven selection |

| North Sky Capital | Power, storage, water, waste | 9-12% | Impact + financial gains |

| Clean Energy ETFs (ICLN/CTEC) | Global renewables and cleantech | Market-linked | Liquid, low-fee access |

Benefits and Risks of Investing in Sustainable Infrastructure

Benefits:

Resilience: Lower volatility and inflation hedging via essential services.

ESG alignment: Positive environmental and social impact, appealing to younger investors.

Growth potential: Driven by net-zero goals and emerging market needs.

Risks:

Illiquidity: Often 10+ year investment horizons.

Regulatory changes: Policy shifts can impact project viability.

Technology risks: Emerging areas like energy storage face technical uncertainties.

You can mitigate these risks through diversified funds and platforms offering vetted opportunities.

Funding Sources for Sustainable Urban Infrastructure

Sustainable urban infrastructure projects draw from a diverse ecosystem of funding sources that extends far beyond traditional municipal budgets. Institutional investors, venture firms, corporate backers, and public financiers are increasingly directing capital toward scalable solutions in green construction, energy efficiency, smart cities, and sustainable materials. Multilateral development banks like the World Bank and European Investment Bank serve as major catalysts, with the World Bank maintaining an active portfolio of 192 urban development projects totaling $34.8 billion and investing approximately $5 billion annually in sustainable urban development.

These institutions, along with specialized mechanisms like the City Climate Finance Gap Fund, help cities transform low-carbon ideas into finance-ready projects by providing not just capital but also technical assistance, project preparation support, and capacity building. Land-based financing instruments such as betterment levies and transferable development rights enable governments to capture increased property values from public infrastructure improvements, while sustainable infrastructure investors can tap into growing markets like green bonds and impact funds. Government agencies including the U.S. Department of Energy, UK Research and Innovation, and national development banks are also significant players, providing grants, research funding, and debt financing to accelerate the transition to climate-resilient cities.

How to Get Started with Sustainable Infrastructure Investments

Begin with a 10-20% portfolio allocation for diversification. Use platforms like Paperfree for private funds or brokerages for ETFs. Conduct due diligence on sustainability credentials—look for labels like FAST-Infra.

Consult advisors, as these investments suit accredited or high-net-worth individuals seeking long-term growth.

Conclusion

Sustainable infrastructure funds offer a compelling blend of defensive returns, impact, and growth for 2026 portfolios. As the world bridges the infrastructure gap with greener solutions, these alternatives position investors for resilience amid transition. Explore options today to diversify effectively.

Frequently Asked Questions

What are sustainable infrastructure funds?

Sustainable infrastructure funds invest in projects like renewables, water systems, and green transport that deliver economic returns while prioritizing environmental and social resilience.

Why invest in sustainable infrastructure in 2026?

Trends like soaring renewables, grid upgrades, and decarbonization drive growth, offering 8-15% returns with low correlation to stocks amid volatility.

What are the best sustainable infrastructure funds for 2026?

Top managers include Copenhagen Infrastructure Partners, Brookfield Renewables, and J.P. Morgan Sustainable Infrastructure; ETFs like ICLN offer accessible entry points.

What returns can sustainable infrastructure funds provide?

Expect 8-12% annual yields or 10-15% IRR from stable cash flows in long-term projects, often outperforming traditional infrastructure.

How do sustainable infrastructure funds fit into alternative investments?

They provide diversification, inflation protection, and ESG benefits, ideal alongside real estate or private equity in 2026 portfolios.

Pages Related to #sustainable infrastructure fund

- Investment Marketplace by Paperfree, alternative investments and more

- 6 Factors to Consider When Investing in Real Estate

- [closed] CMF. Cedar Multifamily Fund

![[closed] CMF. Cedar Multifamily Fund](https://d2sv4n3pfes7l9.cloudfront.net/file_paperfree_144_2020-8-21-19-57-p_pf-avatar.jpg)

- What are alternative investments? How can alts improve your portfolio?

- Alternative investment marketplace: Private Equity, Private Equity Real Estate Investment Opportunities.

- Alternative investments guide. How to invest. Types of Alts | Paperfree

- EB-5 for Tech Entrepreneurs: Immigration Program for Startup Founders | Paperfree

- EB5 Visa Bulletin June 2025: Priority Dates & Filing Updates

Popular Page

Private Real Estate Funds - Investments to Drive Income and Capital Growth

Book a Free Complimentary Call

Search within Paperfree.com

real estate investing Investment Visa USA Investment Magazine Private Real Estate Funds real estate funds