What is Capital Growth Strategy? Growth of Equity: Advantages and Disadvantages.

Focusing on capital growth investments can be rewarding if you learn all about investing in medium to high-growth assets within a well-structured portfolio.last updated Saturday, August 9, 2025

#capital growth investments #growth capital

|

|

by John Burson |

Content Manager, Paperfree Magazine |

QUICK LINKS

AD

Get Access to Real Estate Investment Opportunities

The "capital growth" phrase seems self-explanatory. Capital growth is the ultimate goal for most investors, particularly those who are comfortable with taking on higher risks. Achieving growth requires a deep understanding of the principles of capital growth and asset classes that may fuel it. Once you have all the details, you'll be better prepared to decide whether a strategy is the best option for you.

We are about to reveal all the details about capital growth, including:

- How it works as an investment strategy

- How to fuel capital growth in real estate

- Various growth investments

- Growth strategies: advantages and disadvantages

What are Capital Growth Investments?

Capital Growth is also known as capital appreciation; capital growth is the appreciation of investment value over time.

Capital growth formula, calculation.

The "capital growth" is the difference between the current/market value of the investment and the original purchase price.

For example,

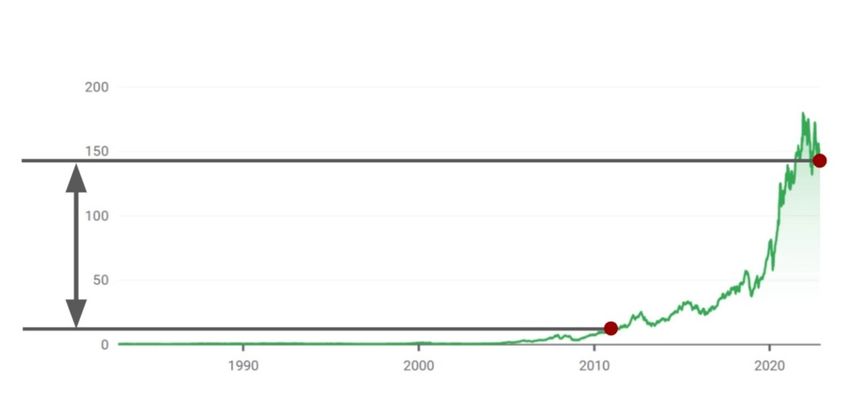

- Suppose you bought Apple stock (NASDAQ: AAPL) at $9.82 a share in 2010.

- Since the stock's current (Nov 2022) price is around $134 a share,

your capital growth would be about $134.00-$9.82=$124.18 per share.

Fig 1. Capital Growth. Source: Google Finance

What is a Capital Growth Strategy?

The objective of growth capital investors is to buy an asset with growth potential. Considering this approach, one might expect that every growth investor would seek the tremendous gains in value that Apple stock has provided its shareholders since 2010. However, finding a low-valued stock ready to launch into a phenomenal growth curve is difficult.

Only a few growth capital investments will produce Apple-like appreciation over the next 10 to 20 years.

Some capital growth investments may decrease in value. Even in Apple's case, a 2010 Fortune article reported that stock in the growing tech company was a risky investment at that specific time.

Generally, the higher the growth potential, the greater the associated risks. This is why experienced investors attempt to mitigate risk exposure by using a diversification process in asset allocation.

Diversification helps reduce risk in a capital growth portfolio by including moderate to high-growth assets with low correlation to each other.

Common Investment Strategies for Capital Growth

Several traditional and alternative asset investments can qualify as capital growth investments. However, equities and real estate are two popular investment types for capital growth. Although equities can yield income through dividends, real estate can generate rental income. Still, investors focus on growth through price appreciation.

Here are some of the most common asset classes that promote equity growth.

Growth of Equity as an asset class

Many investors purchase the high-growth stocks of tech or biotech companies because, historically, many have produced impressive gains in value over the last years. However, since these equities must constantly meet or beat analysts' profit expectations, they carry a high-risk factor. Additionally, non-dividend-paying companies make the best capital growth prospects because they usually use the proceeds from capital growth to fund acquisitions, expansion, or capital investments. Conversely, companies that pay dividends tend to be well-healed entities with stocks that yield steady but hold modest equity growth.

Growth of Capital through Real Estate Investment Strategy

Real estate investments are tangible assets, meaning their intrinsic worth depends on physical qualities and market conditions. Although some real estate investments yield rental income, capital growth in real estate refers to the rise in the value of your property over time.

Capital growth in real estate assets also carries varying levels of risk. For instance, you could buy property in a depressed region that promises impressive growth.

Alternatively, you could make a capital growth investment in property in an established area with moderate value increases, and there are tactics to accomplish it.

Either way, you should consider the wide range of liquidity risks when investing in real estate assets. Because of this, you may need to commit capital to certain property assets for long periods.

Capital Growth with Investment Funds

Some investors opt for a more measured approach to capital growth by choosing mutual funds and exchange-traded funds (ETFs). These investment instruments are pre-packaged groupings of stocks and bonds. As such, you can select a fund that aligns with the risk level and growth strategy you prefer.

Commodities and Capital Growth

Besides being a sound investment for stock portfolio diversification, commodities like oil, gold, gas, or natural gas can lead to capital growth with their increase in value over time.

Advantages and Disadvantages of a Capital Investment Growth Strategy

Benefits of a Capital Growth Strategy

With sound planning and sensible investment choices, you can receive many advantages from a capital growth strategy, including the following.

- Wealth building

Capital appreciation builds wealth. Buying assets at a bargain price and selling them at a high price promotes a robust revenue-generating portfolio. - Tax deferment

A capital growth strategy provides a tax haven since you don't have to pay taxes on an investment until you sell. This benefit primarily benefits capital growth securities that pay dividends or real estate properties that yield rental income. With income-yielding capital investments, you pay taxes on the annual income but not the capital appreciation. - Meeting long-term goals

If you are looking for long-term investment rewards, a sound capital growth strategy can help you reach that goal. In addition, with proper planning, a capital growth strategy can help you meet your retirement savings goals or build a sizeable estate to pass down to your heirs.

Disadvantages of a Capital Growth Strategy

As previously stated, a capital growth strategy is not for every investor. There are potentially severe disadvantages that accompany a capital growth strategy. Here are the most common.

- You could suffer significant losses.

Capital growth investments range from medium to high risk. You risk losing a substantial amount of your capital, which is why investors with a low risk tolerance choose an income or preservation investment strategy. - Liquidity issues

A capital growth strategy is more conducive to long-term investments. As a result, you must be able to allow copious amounts of money to lay dormant for many years before your assets reach the desired appreciation. - Lack of short-term growth

Capital growth stocks are generally a long-term investment. Consequently, they yield little or no short-term returns.

Is Capital Growth Strategy Best for You?

Typically, ideal capital growth investors are patients with a high-risk tolerance and the resources to commit a significant portion of their capital to a high but long-term equity growth curve. They must also be willing to perform intensive due diligence, pay a reputable professional, or invest in capital growth groups or funds.

If this investor profile is close to fitting you, you have the makings of a capital growth investor. Otherwise, you could dedicate a portion of your portfolio to capital growth.

Q&A

Do real estate and equity capital growth investors have the same capital growth strategy?

Although equities can earn income through dividends and real estate can produce rental income, capital growth investors seek growth through rising asset values.

There are real estate investment strategies optimized for capital growth:

To benefit from a capital growth strategy, do I have to be an experienced investor?

No, even if you are a novice investor, you can benefit from capital growth investments by purchasing shares in a managed index fund, a 401(k) plan, or by managing a market-neutral portfolio that includes some capital growth assets.

Which Asset Class is the best prospect for growth capital?

Stocks give investors the most significant potential for long-term capital appreciation. The return from stock assets can be substantial for investors willing to hold onto stocks for around 15 years.

Where to invest for long-term growth?

There are many factors to consider when deciding where to invest for long-term growth, including your financial goals, risk tolerance, and investment time horizon. Here are a few options to consider:

- Stock market investing

Investing in the stock market through a diverse portfolio of stocks or mutual funds can provide the potential for long-term growth. - Real estate investing

Investing in real estate through rental properties or REITs (real estate investment trusts) can provide the potential for long-term growth and steady income. - Bonds Investing

Investing in bonds, particularly long-term bonds, can provide a steady stream of income and the potential for capital appreciation. - Mutual funds investing

Investing in mutual funds, which are investment vehicles that pool together money from many investors and invest in a diversified portfolio of stocks, bonds, and other securities, can provide the potential for long-term growth.

It's essential to remember that investing carries risks, and there is no guarantee that you will achieve your financial goals. It's a good idea to consult a financial advisor or professional before making investment decisions.

Pages Related to #capital growth investments

Popular Page

Private Real Estate Funds - Investments to Drive Income and Capital Growth

Book a Free Complimentary Call

real estate investing Investment Visa USA Investment Magazine Private Real Estate Funds real estate funds