Your Ultimate Guide to Industrial Real Estate Investment

Explore the Types of Industrial Properties, Investment Strategies, Key Drivers of Growth, and Expert Insights for Building Wealth Through Industrial Real Estatelast updated Thursday, January 15, 2026

#industrial real estate investment strategy #investing in industrial real estate

|

|

by John Burson |

Content Manager, Paperfree Magazine |

QUICK LINKS

AD

Get Access to Real Estate Investment Opportunities

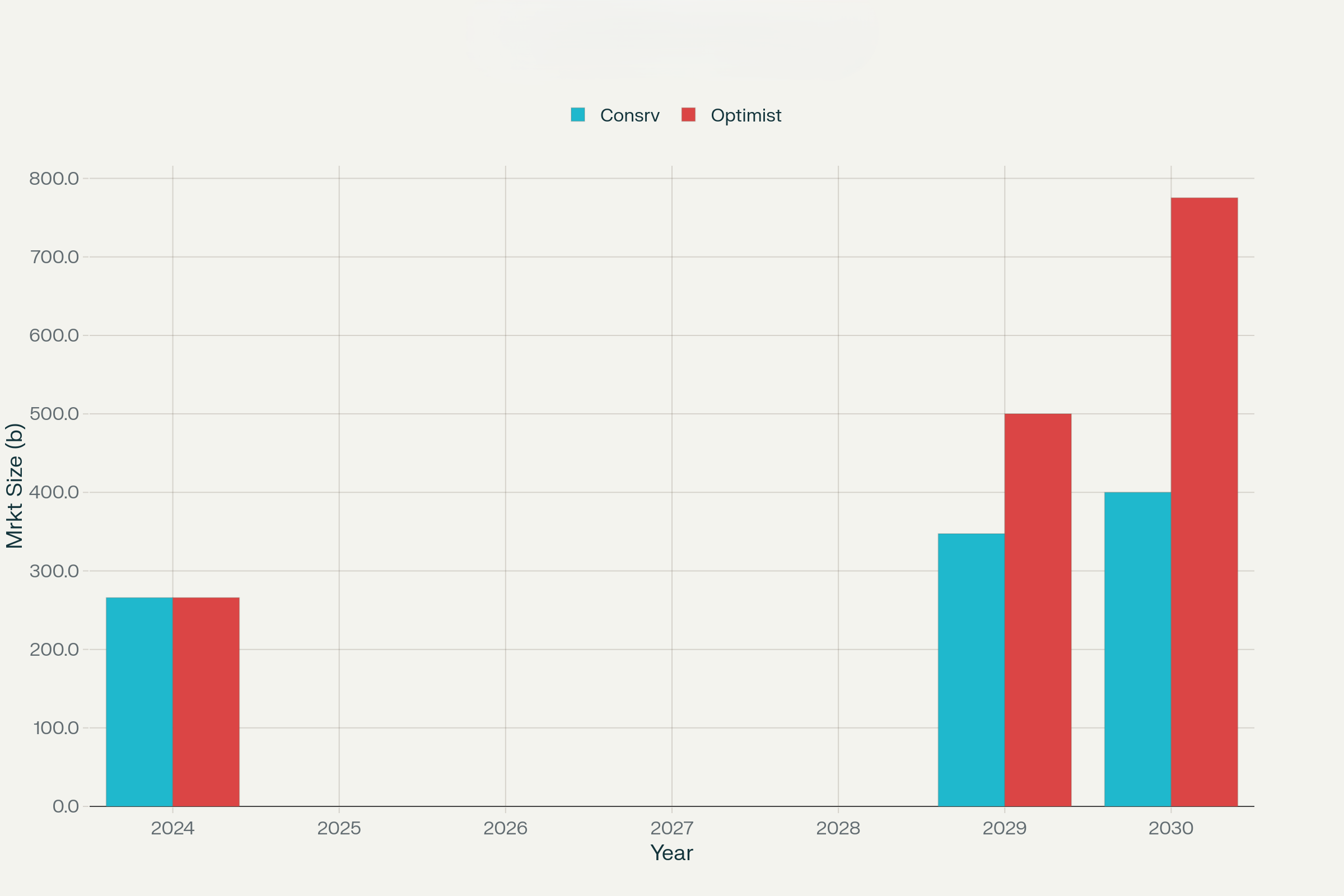

Industrial real estate represents one of the most lucrative and resilient investment opportunities in today's Market, with the global sector valued at $265.84 billion in 2024 and projected to reach $775.3 billion by 2030. This comprehensive guide covers every aspect of industrial property investment, from understanding market fundamentals to implementing successful investment strategies.

Understanding Industrial Real Estate Investing

Industrial real estate investing involves properties designed and zoned for industrial activities, including manufacturing, production, assembly, warehousing, research, storage, and the distribution of goods.

Industrial real estate is located in designated city zones, strategically separated from residential and commercial areas to prevent operational conflicts and maintain community harmony. This zoning approach ensures that heavy machinery, truck traffic, and industrial processes don't disrupt nearby businesses or neighbourhoods.

The rise of e-commerce has fundamentally transformed the priorities of industrial real estate. With consumer expectations shifting toward rapid delivery times—including same-day service—logistics companies are increasingly positioning their warehouses and distribution centres closer to urban populations. This trend, often called "last-mile logistics," has created high demand for industrial properties in metropolitan areas, driving innovation in warehouse design and urban planning to accommodate these evolving needs while managing space constraints and higher real estate costs.

*Industrial Real Estate Market Growth Projections (2024-2030)

*Industrial Real Estate Market Growth Projections (2024-2030)

Market Size and Growth Trajectory

The industrial real estate market has demonstrated exceptional resilience and growth potential:

- Global market size in 2024: $265.84 billion to $1.1 trillion (using varying methodologies).

- Projected CAGR 2024-2030: 5.5% to 6.5%.

- Asia-Pacific dominance: 36.15% of global market share ($96.1 billion).

- Industrial transaction share: 39.6% of all commercial real estate transactions in 2024.

Why Invest in Industrial Real Estate?

Industrial real estate offers a compelling case for investors looking for stability and high returns. Here's why industrial properties have become such an attractive investment option.

Special Benefits:

- Strong Demand Driven by E-Commerce

The growth of e-commerce has dramatically increased the demand for warehouse and distribution centers. According to CBRE, global e-commerce sales are expected to continue growing, driving demand for additional industrial space. - Higher Yield Potential

Industrial properties generally offer higher rental yields than other commercial real estate types. According to recent data, industrial real estate has outperformed other sectors in both rent growth and capital appreciation. - Stability and Lower Volatility

Industrial real estate is generally considered more stable than other commercial property types because tenants often sign long-term leases (10 years or more). Additionally, demand for warehouse and logistics spaces remains consistent, as these properties are essential to supply chains and manufacturing. - Inflation Hedge

Industrial real estate can act as a hedge against inflation. Rent increases tied to inflation or periodic lease renewals protect against the erosion of purchasing power, making industrial properties attractive in times of economic uncertainty. - Tax Benefits

Investors in industrial real estate can take advantage of various tax benefits, including depreciation deductions, which can offset taxable income. Additionally, many industrial properties qualify for Opportunity Zone investment incentives, which provide tax benefits for investing in economically distressed areas.

Superior Financial Performance

Industrial properties have historically outperformed other commercial real estate sectors, offering attractive financial returns:

- Rent Growth

Industrial rents grew 6.9% year over year in 2024. - Rental Spreads

Industrial properties continue to see strong rental spreads, averaging over 40% in some markets. - Consistent Returns

After four consecutive positive periods, industrial properties returned 3.3% in recent quarters.

The demand for industrial space, particularly driven by e-commerce growth and supply chain restructuring, continues to fuel rent and price appreciation. CoStar reports that demand for industrial properties is outpacing supply in major global markets, pushing up rental rates.

E-Commerce and Supply Chain Drivers

The surge in online shopping has been a major driver of industrial real estate demand. Key trends include:

- E-Commerce Growth

The e-commerce sector is expected to grow at 9% annually, directly boosting demand for warehouses and distribution centres. - Supply Chain Resilience

In response to global disruptions, companies are investing in domestic industrial capacity, strengthening the appeal of industrial assets. - Automation

The increased adoption of automation technologies in warehouses is creating a demand for state-of-the-art facilities that support robotic systems and AI.

As companies streamline their supply chains, demand for industrial real estate will likely continue to rise. According to a JLL report, demand for warehouse and distribution space is expected to remain high over the next decade.

Favourable Market Fundamentals

Industrial properties benefit from strong market fundamentals, including:

- Low Vacancy Rates

National vacancy rates for industrial real estate range from 6.4% to 7.5%. - Limited New Supply

In 2024, only 330.7 million square feet of new industrial space were delivered, highlighting supply constraints. - Strong Tenant Creditworthiness

Many industrial leases are long-term and backed by investment-grade tenants, making them stable, income-generating assets.

These factors contribute to the stability of industrial real estate, even during economic downturns.

Best Performing Industrial REITs

1. Prologis, Inc. - PLD

2. Public Storage - PSA

3. Extra Space Storage Inc. - EXR

4. Lineage, Inc. - LINE

5. CubeSmart - CUBE

6. Rexford Industrial Realty, Inc. - REXR

7. EastGroup Properties, Inc. - EGP

8. First Industrial Realty Trust, Inc. - FR

9. STAG Industrial, Inc. - STAG

10. Terreno Realty Corporation - TRNO

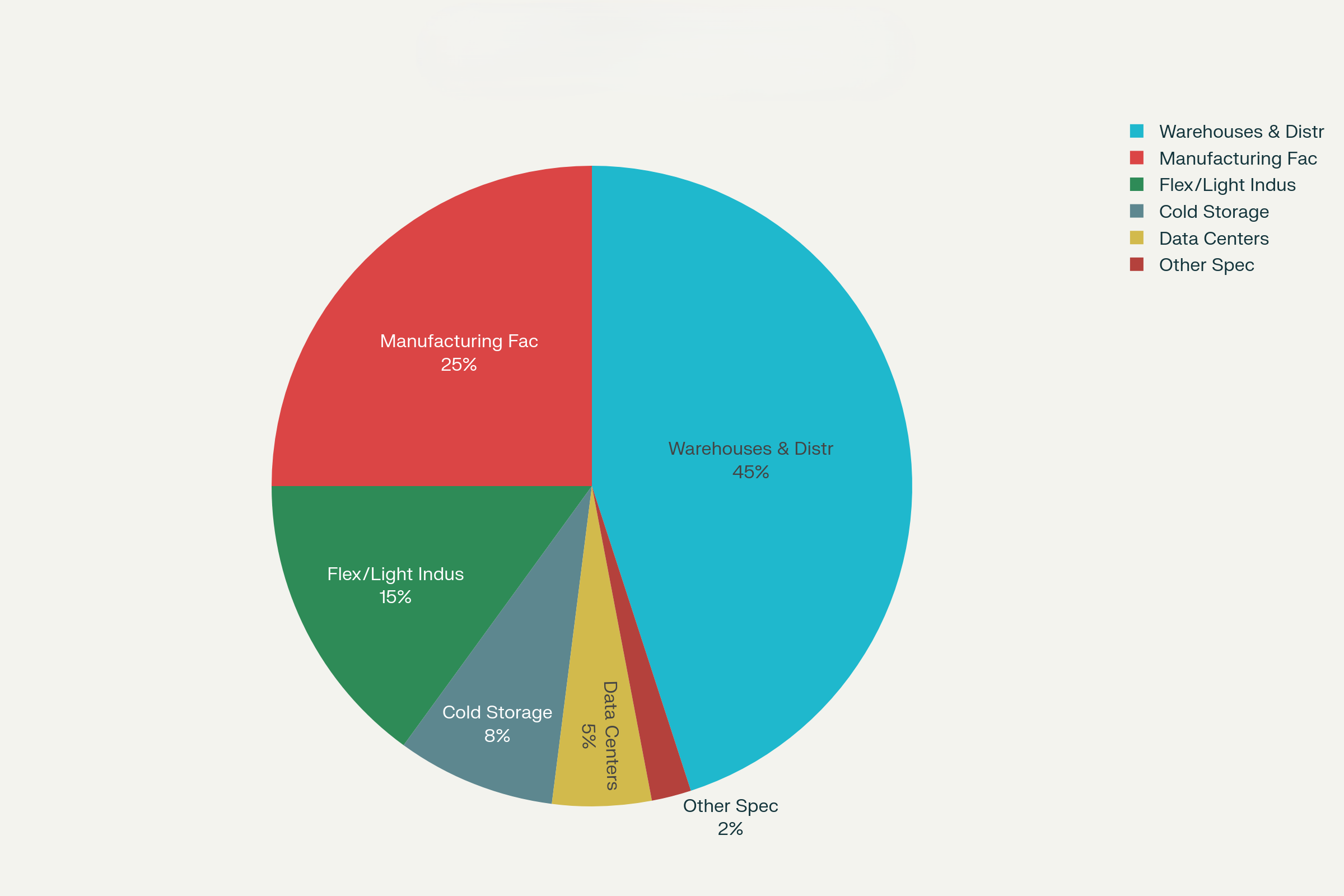

Types of Industrial Real Estate Investment Properties

Industrial real estate is a dynamic sector offering diverse investment opportunities. With increasing demand across various industries, it's essential to understand the different types of industrial properties and their specific characteristics. Below are the primary industrial property types, their features, and the reasons they are attractive to investors.

*Industrial Real Estate Investment Types Breakdown by Property Category

1. Warehouses and Distribution Centres (45% of Market)

As the backbone of modern logistics, warehouses and distribution centers are in high demand, especially with the growth of e-commerce. These properties are crucial for the storage and rapid distribution of goods. The key attributes include:

- High Ceiling Heights

Typically ranging from 28 to 40 feet, providing ample space for stacking and storing goods. - Strategic Locations

Often located near transportation hubs, such as highways, ports, and airports, for efficient distribution. - Automation Integration

The rise of automated sorting systems and robotics has increased demand for state-of-the-art warehouses. - Last-Mile Delivery Capabilities

Proximity to urban areas enables quick deliveries, a growing need due to the surge in online shopping.

The demand for warehouses continues to rise as e-commerce giants such as Amazon and Walmart expand their distribution networks. With increasing online retail sales, warehouses remain a prime investment choice. According to a CBRE report, global industrial real estate is expected to grow steadily over the coming years, making it a reliable long-term investment.

2. Manufacturing Facilities (25% of Market)

Manufacturing facilities serve as the heart of production for many industries, from automobiles to electronics. These properties are designed to support heavy machinery and large-scale production. Key characteristics include:

- Heavy Machinery Infrastructure: Properties equipped with specialised infrastructure to house production lines, large equipment, and machinery.

- Power-Intensive Needs: Manufacturing facilities often require significant energy resources, making them more suitable for areas with stable and affordable energy supplies.

- Regulatory Compliance: Many facilities must adhere to strict environmental and safety standards, making them attractive to investors seeking long-term stability.

These facilities are typically leased for long-term periods, providing stability and consistent cash flow to investors. According to JLL, manufacturing and industrial property demand in North America is expected to grow significantly as production increases to meet domestic and international demand.

3. Flex and Light Industrial (15% of Market)

Flex spaces offer versatile properties that combine office space and light manufacturing or warehousing. These properties are ideal for businesses with evolving needs. Here's what makes them attractive:

- Adaptable Layouts

These properties can easily shift between warehouse, office, and light-manufacturing uses, serving a range of industries. - Lower Capital Requirements

Compared to larger manufacturing facilities, flex spaces typically have lower upfront costs. - Higher Rent Premium

Due to their adaptability, these properties often command premium rents from tenants who need flexible terms.

For small- to medium-sized enterprises (SMEs) and startups, flex and light-industrial spaces provide an ideal environment for scaling operations. As businesses seek adaptable solutions, the demand for these properties continues to rise. The flexibility these spaces offer makes them an appealing choice for businesses in dynamic sectors.

4. Cold Storage Facilities (8% of Market)

Cold storage facilities, designed for temperature-sensitive products, are increasingly in demand, particularly in the food and pharmaceutical industries. Key features include:

- Temperature Control

These properties are equipped with advanced systems to store perishable goods at regulated temperatures. - Specialised Uses

Cold storage is essential for storing food, pharmaceuticals, and chemicals that require strict temperature control. - Premium Rental Rates

Given the specialized nature of cold storage, these facilities typically generate higher rental rates.

With increasing demand for online food deliveries and pharmaceutical products, cold-storage capabilities are becoming more valuable, as highlighted in a Knight Frank report. Cold storage investment is expected to rise, driven by growing global e-commerce and logistics demand.

Industrial Real Estate Investment Strategies

Understanding various investment strategies helps investors tailor their portfolios to their risk tolerance and financial goals. Below are the most common industrial real estate investment strategies.

Core Investment

The core investment strategy focuses on high-quality, stabilized properties with strong tenants, minimal capital improvement needs, and predictable cash flows. Ideal for conservative investors, core properties include:

- Class A distribution centers

- Modern manufacturing facilities

- Long-term lease properties

These properties typically offer returns of 6-8% annually. CBRE suggests that these types of properties provide consistent income generation with low volatility.

Explore all Real estate investment strategies to grow and preserve wealth.

Value-Add

Investors using the value-add strategy focus on acquiring underperforming properties and improving their operational efficiency.

By upgrading facilities or enhancing tenant mixes, investors aim to generate higher returns (10-15%). Some common value-add opportunities include:

- Modernizing facilities

- Restructuring leases

- Improving operational efficiency

This strategy offers the potential for higher returns but also comes with increased risk. NAIOP emphasizes that this strategy requires a deep understanding of property management and market conditions.

Opportunistic

The opportunistic strategy is a high-risk, high-reward approach. It involves investing in distressed properties or development projects in high-growth markets. Returns of 15-20%+ are targeted. This strategy often includes:

- Ground-up construction

- Development in supply-constrained markets

- Distressed asset acquisitions

Opportunistic investors must be willing to navigate market volatility and capitalize on emerging opportunities.

Public Top Industrial Real Estate Investment Companies

Several investment firms and funds specialize in industrial real estate, offering a range of options for both public and private investors.

Public REITs

- Prologis (PLD)

Specializes in logistics real estate with a global portfolio valued at over $197.5 billion. - EastGroup Properties (EGP)

Focuses on Sunbelt markets with a growing development pipeline. - STAG Industrial (STAG)

Diversified industrial portfolio with a value-driven investment approach.

Specialized Fund Managers

Industrial Property Investment Fund (IPIF):

A UK-focused fund with over £2 billion in assets, specializing in multi-let properties.

These firms and funds offer different entry points for investors, whether they prefer the stability of publicly traded REITs or the hands-on approach of private equity.

Private Equity Firms Focused on Industrial Real Estate

Industrial-focused private equity firms specialize in investing in and managing industrial companies and properties. These firms typically acquire, improve, and expand manufacturing, logistics, or distribution companies to drive operational efficiencies and increase profitability. They focus on industries such as manufacturing, construction, and logistics that are vital to the global economy.

Key Characteristics of Industrial-Focused Private Equity Firms:

- Target Industries

These firms usually target industrial sectors such as manufacturing, logistics, automation, construction, and supply chain services. Their goal is to optimize the performance of these companies and properties by implementing operational improvements, expanding market reach, and increasing technological integration. - Long-Term Investment Horizon

Industrial-focused private equity firms typically invest with a long-term perspective, aiming to generate value through strategic management, process optimization, and capital improvements. Their investments are generally held for 3-7 years before being sold or taken public. - Active Involvement

Unlike passive investors, private equity firms often take an active role in the operations of the businesses they acquire. They may bring in experienced management teams, implement new technologies, or expand production capacities to improve efficiency and growth.

Top Industrial Focused Private Equity Firms

KPS Capital Partners

- Assets Under Management (AUM): $21.4 billion

- KPS Capital specializes in industrial and manufacturing companies, focusing on acquiring and improving businesses within these sectors. They focus on controlling equity investments, implementing operational improvements, and driving value creation.

CORE Industrial Partners

- AUM: $1.58 billion

- CORE targets North American manufacturing companies, particularly in the lower middle market. The firm works with businesses to enhance operational performance and create long-term growth through investments in plant and equipment, automation, and global expansion.

Blackstone

- AUM: $602 billion

- Blackstone is one of the largest private equity firms globally and has a significant presence in industrial real estate. It invests in diversified industrial portfolios and has a dedicated fund focusing on logistics, manufacturing, and supply chain companies.

Carlyle Group

- AUM: $293 billion

- The Carlyle Group focuses on investing in global industrial companies, particularly those in the manufacturing and infrastructure sectors. They seek to improve performance through operational restructuring, acquisitions, and technological integration.

TPG Capital

- AUM: $96 billion

- TPG is another major player in industrial private equity, investing in sectors such as manufacturing, energy, and logistics. They have a history of using technological upgrades and sustainability initiatives to drive profitability and market competitiveness.

How Industrial Private Equity Firms Create Value?

- Operational Improvements

Industrial-focused private equity firms often focus on optimizing supply chains, improving production processes, and upgrading technologies. They may implement lean manufacturing practices or invest in automation to increase efficiency and lower costs. - Strategic Acquisitions

Industrial private equity firms also grow their portfolio companies by making strategic acquisitions that complement or expand existing operations. This can include acquiring competitors or related businesses to create a more integrated value chain. - International Expansion

Some industrial-focused private equity firms invest in expanding operations into new markets, including global markets. This can increase revenue streams and reduce exposure to domestic market volatility.

Industrial-focused private equity firms provide an essential link in the investment world by focusing on industrial sectors that support the global supply chain. With active management, they aim to improve operations and increase the value of their investments over time.

How to Invest in Industrial Real Estate

Investing in industrial real estate can be an attractive option for investors seeking stable returns and portfolio diversification. To begin investing in industrial real estate, follow these key steps:

1. Understand the Market

- Research

Before investing, it's crucial to understand the market dynamics, including trends in e-commerce, manufacturing, logistics, and supply chains. Familiarize yourself with market reports, such as those from CBRE or JLL, which provide detailed insights into industrial property trends. - Location Analysis

Industrial real estate investments are highly location-dependent. Look for properties near transportation hubs such as ports, airports, highways, and railroads, as these areas offer the best access for logistics and distribution.

2. Choose Your Investment Vehicle

- Direct Investment

This involves purchasing industrial properties directly, either for development, leasing, or resale. Direct ownership requires substantial capital and property management expertise, but it provides complete control over the asset. - Real Estate Investment Trusts (REITs)

If you prefer a more hands-off approach, consider investing in industrial REITs, which pool funds to invest in a diversified portfolio of industrial properties. Publicly traded REITs, such as Prologis, are ideal for investors seeking liquidity and low barriers to entry. - Private Equity Firms

Investing through private equity firms focused on industrial properties is also an option. These firms typically acquire, manage, and optimize industrial assets to generate returns. Examples include CORE Industrial Partners.

3. Secure Financing

- Commercial Mortgages

Traditional commercial loans are standard for purchasing industrial properties, with longer terms and higher loan-to-value ratios than residential mortgages. - SBA Loans

The SBA 7(a) and SBA 504 programs are excellent options for those buying owner-occupied industrial properties. These loans offer lower interest rates and longer repayment terms. - Bridge Loans

If you are purchasing a distressed property or need fast capital, bridge loans can provide short-term financing to close deals quickly.

4. Due Diligence

- Physical Inspections

Inspect the property for its structural integrity, load-bearing capacity, and compliance with zoning and environmental regulations. - Market Analysis

Assess the rental rates, vacancy rates, and tenant quality. Evaluate the potential for capital appreciation based on long-term market trends.

Best Industrial Real Estate Investment Strategy

When investing in industrial real estate, a solid strategy is key to maximizing returns while minimizing risk. Here are the top strategies investors use:

1. Core Strategy (Stabilized Assets)

This strategy involves investing in high-quality, fully leased industrial properties with stable tenants and predictable cash flow. These properties are typically low risk and located in prime markets. The focus is on generating consistent rental income with minimal management intervention. Investors often target Class A warehouses and distribution centers that have long-term lease agreements.

2. Value-Add Strategy

Investors who choose the value-add strategy acquire properties that require some form of improvement, whether through renovations, tenant upgrades, or operational efficiency improvements. By improving the property’s condition or tenant mix, the investor can command higher rental rates and increase the property's overall value. This strategy typically offers a higher return potential (10-15%) but requires active management.

3. Opportunistic Strategy

This high-risk, high-reward strategy involves investing in distressed or underperforming industrial properties that require significant rehabilitation or repositioning. Opportunistic investors typically look for assets in emerging markets or undergoing redevelopment to capitalize on future growth. These investments are generally more speculative and may include ground-up construction or acquisitions in underserved areas.

4. Development Strategy

Investors using the development strategy build new industrial properties or undertake significant redevelopment projects in supply-constrained areas. This strategy often requires more capital and time but offers the potential for high returns, particularly in markets experiencing a lack of available industrial space. Investors in this strategy should pay close attention to market conditions and future demand trends.

5. REIT Strategy

Real Estate Investment Trusts (REITs) allow investors to diversify their portfolios by investing in a basket of industrial properties without owning them directly. REITs like Prologis allow investors to buy shares in large portfolios of industrial properties, including warehouses, manufacturing facilities, and distribution centers. This strategy offers liquidity and lower upfront capital requirements compared to direct investments.

Discover Real Estate Investment Strategies at Paperfree marketplace for alternative investments.

Bottom Line: Investing in Industrial Real Estate | Tips for Success

- Focus on Long-Term Growth

An industrial real estate investment fund typically requires a long-term perspective. Look for properties in areas with strong growth potential, whether due to infrastructure development, population growth, or business expansion. For example, areas near new transportation hubs or distribution centers can offer long-term upside potential. - Diversify Your Portfolio

Diversification is a key element in any investment strategy. Consider diversifying across different types of industrial properties (e.g., warehouses, manufacturing, and flex spaces) and geographic regions to minimize risks. - Keep an Eye on Market Trends

Stay updated on global and local industrial real estate trends. - Due Diligence is Critical

Thorough due diligence is essential in industrial real estate investing. Continually evaluate the physical condition of the property, the quality of tenants, and the overall market dynamics before making a purchase. This includes legal checks, financial assessments, and environmental audits.

Frequently Asked Questions

1. Is industrial real estate a good investment?

Yes, industrial real estate offers strong returns with stable, long-term leases and growing demand driven by e-commerce and logistics trends.

2. What types of industrial properties generate the best returns?

Warehouses and distribution centers typically provide the highest yields, especially modern facilities near transportation hubs.

3. How does industrial real estate compare to residential or office investments?

Industrial real estate generally delivers higher risk-adjusted returns with lower volatility compared to residential or office properties.

4. What are the typical investment minimums for industrial real estate?

Direct ownership often requires millions in capital, but investors can access the sector through industrial REITs or crowdfunding with lower minimums.

5. Which markets currently show the strongest industrial real estate growth?

Key markets include the Inland Empire (CA), Dallas-Fort Worth, Atlanta, Savannah, and Los Angeles, driven by logistics demand and population growth.

6. What are the main risks, and how can investors mitigate them?

Risks include economic downturns, tenant concentration, and market volatility. Diversification, choosing recession-resistant tenants, and focusing on prime locations help mitigate risks.

Pages Related to #industrial real estate investment strategy

- 4 Ways to Better Organize Inventory Management

- Hard Money Lending Versus Real Estate Crowdfunding

- How to Spot and Avoid Hard Money Scams

- Hard Money Jumbo Loans in 2025: Latest CFPB Updates & Analysis

- Here are eight important questions to ask hard money lenders to make informed investment decisions.

- 5 Common Mistakes to Avoid When Investing in Real Estate

- Are You Paying Too Much for a Real Estate Investment Property?

- Hard Money Loan Brokers and Wholesalers

Popular Page

Private Real Estate Funds - Investments to Drive Income and Capital Growth

Book a Free Complimentary Call

real estate investing Investment Visa USA Investment Magazine Private Real Estate Funds real estate funds