Real Estate Investment Principles by Bruce Flatt the CEO of Brookfield Asset Management

Learn Brookfield Investment Thesis and Fundamentals were presented by CEO Bruce Flatt at Google Office.last updated Tuesday, January 6, 2026

#j bruce flatt #real estate investment principles

|

|

by John Burson |

Content Manager, Paperfree Magazine |

QUICK LINKS

AD

Get Access to Real Estate Investment Opportunities

Bruce Flatt, as CEO of Brookfield Asset Management, has established himself as one of the world's most successful real estate investors, transforming Brookfield into a global powerhouse with over $900 billion in assets under management. His investment principles center on a counter-cyclical, value-oriented approach- acquiring high-quality assets in premier locations when they're undervalued, implementing operational improvements, and maintaining the financial flexibility to capitalize on market dislocations.

This patient capital strategy, combined with Brookfield's vertically integrated operating capabilities and global reach, has delivered exceptional long-term returns, outperforming market benchmarks for decades while building one of the world's largest real estate portfolios spanning office, retail, multifamily, logistics, and renewable energy assets.

Video transcript

Bruce Flatt: "... I would say to anyone that there's never a right strategy in investing. It's whatever strategy fits you and what you want to do."

Brookfield Investment Thesis

Brookfield Fundamentals of Investments

source: YouTube

- Invest where we possess competitive advantages.

- Acquire assets on a value basis to maximize return on capital.

- Find assets with inherent cash flow (today or soon) and build sustainable cash flows to provide certainty, reduce risk, and lower the cost of capital.

- Recognize that superior returns often require contrarian/go against current practice thinking.

About J Bruce Flatt

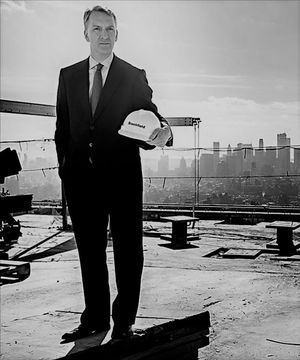

Fig 3. J Bruce Flatt, CEO of Brookfield Asset Management, Inc.

photo credit: www.forbes.com

Because of his value investment style, Bruce Flatt has been referred to as the Canadian Warren Buffett.

J Bruce Flatt net worth

He was ranked #622 on Forbes' Billionaires list with a $4.5B net worth. (2022)

source: Wikipedia

Bruce Flatt: The Architect of Brookfield's Success

Bruce Flatt has served as the Chief Executive Officer of Brookfield Asset Management since 2002, though his tenure with the company began in 1990. Under his leadership, Brookfield has transformed from a primarily Canadian-focused investment firm into one of the world's largest alternative asset managers with significant global real estate holdings. His influence on the firm's investment philosophy has been profound, with the company growing its assets under management from approximately $5 billion to over $850 billion during his leadership period. This remarkable growth trajectory has earned Flatt recognition as "the Warren Buffett of real assets" for his value-oriented approach and exceptional long-term investment results.

Flatt's background as an accountant by training has informed his methodical approach to analyzing investment opportunities. His leadership style combines disciplined financial assessment with bold contrarian moves when market conditions create undervalued opportunities. The organizational culture he has cultivated at Brookfield emphasizes patience, operational excellence, and a long-term investment horizon spanning decades rather than quarters. This approach has allowed Brookfield to weather multiple market cycles while consistently growing shareholder value.

Brookfield Asset Management has established itself as a dominant force in real estate and infrastructure investing globally under Flatt's guidance. The firm manages investments across real estate, infrastructure, renewable power, private equity, and credit, with real estate forming a substantial portion of its overall portfolio. This diversification across asset classes, combined with geographic spread across the Americas, Europe, Asia, and Australia, has created a resilient investment platform that can deploy capital opportunistically across markets and sectors.

Bruce Flatt Book

Based on our research, Bruce Flatt's book has yet to be published. While we have conducted extensive research, we could not find evidence of the book's publication..jpg)

About Brookfield Asset Management

Fig 4. Brookfield Asset Management building. Toronto, Canada.

Brookfield Asset Management is a global alternative investment and asset manager specializing in real estate, infrastructure, renewable power, private equity, and credit.

The company was founded in 1899 and is headquartered in Toronto, Canada.

Brookfield Asset Management manages assets, including office, retail, residential, and industrial properties; renewable energy projects, such as hydroelectric, wind, solar, and biomass facilities; and infrastructure assets, such as toll roads, airports, ports, and railways.

The company is known for its contrarian investment approach, seeking out undervalued assets in distressed markets and focusing on long-term value creation. Brookfield Asset Management has a track record of delivering solid returns to its investors, and as of 2021, it has over $600 billion in assets under management.

In addition to its investment activities, Brookfield Asset Management is actively involved in corporate social responsibility and sustainability initiatives and is committed to being a responsible and ethical investor.

Related Companies

Brookfield Asset Management, BAM Real-Time Chart

Other real estate investment principles

Source: Break Into CRE YouTube channel

There are four Investing Principles to follow:

1. Am I buying below replacement cost?

2. Are there supply constraints on the local market?

3. Why do you believe the demand will increase in the future?

4. Is there still an upside remaining on the property?

Frequently Asked Questions

What are the key principles outlined by Bruce Flatt for real estate investments?

Bruce Flatt’s key principles include a counter-cyclical investment approach, focusing on premier assets in prime locations, creating value through active operational management, maintaining patient capital with long-term horizons, and emphasizing intrinsic value over market sentiment.

How does Bruce Flatt's approach to real estate investments differ from traditional methods?

Unlike traditional methods that often chase yield or short-term gains, Flatt emphasizes buying high-quality, undervalued assets during market downturns, applying operational improvements, and holding investments for decades to realize long-term value, rather than relying on financial engineering or quick flips.

Can you provide examples of successful real estate investments based on Bruce Flatt's principles?

Notable examples include Brookfield’s acquisition and revitalization of London’s Canary Wharf during Brexit uncertainty, the distress-to-core transformation of General Growth Properties’ retail portfolio after the 2008 crisis, and the strategic assembly and revitalization of office properties in downtown Los Angeles.

What role does risk management play in Bruce Flatt's real estate investment strategy?

Risk management is central, with a focus on maintaining substantial liquidity reserves, conservative and diversified financing, and structuring debt to withstand market cycles. This financial resilience allows Brookfield to invest counter-cyclically and avoid forced sales during downturns.

How does Bruce Flatt's philosophy on real estate investments impact Brookfield Asset Management's portfolio?

Flatt’s philosophy results in a globally diversified, high-quality portfolio concentrated in premier locations, managed with operational excellence, and held for the long term. This approach has driven Brookfield’s growth into one of the world’s largest and most resilient real estate investors, delivering consistent outperformance across cycles.

Bottom Line

Bruce Flatt's real estate investment principles have shaped Brookfield Asset Management into one of the world's most successful property investors and have established a framework that has demonstrated remarkable resilience across diverse market conditions. The consistent application of these principles-counter-cyclical investing, focus on premier assets, operational value creation, and patient capital deployment-has generated exceptional long-term results for investors while building an unparalleled global real estate portfolio.

What distinguishes Flatt's approach is not just its conceptual coherence but its proven effectiveness through multiple real estate cycles. The principles have guided successful investments in both market distress and exuberance, demonstrating their fundamental validity across diverse conditions. This track record suggests that the core principles represent enduring investment wisdom rather than strategies optimized for specific market environments.

For the broader real estate investment community, Flatt's principles offer a valuable framework that can be adapted to diverse contexts and scales. While few organizations can match Brookfield's global reach or capital depth, the underlying philosophies-financial resilience, value orientation, quality focus, and operational excellence-provide relevant guidance for investors across the spectrum. The sustained success of this approach over decades suggests these principles will likely remain relevant as real estate markets continue to evolve.

As real estate markets navigate ongoing challenges from technological disruption, changing work patterns, sustainability imperatives, and economic uncertainties, Flatt's investment framework offers a compass for decision-making grounded in fundamental value while remaining adaptable to evolving conditions. This balance of principled consistency and practical flexibility represents perhaps the most important legacy of Flatt's leadership at Brookfield and his contribution to real estate investment practice.

Pages Related to #j bruce flatt

- How to Spot and Avoid Hard Money Scams

- Here are eight important questions to ask hard money lenders to make informed investment decisions.

- 5 Common Mistakes to Avoid When Investing in Real Estate

- Are You Paying Too Much for a Real Estate Investment Property?

- The Lender Checklist: Finding a Solid Real Estate Investment

- 3 Types of Bad Credit Commercial Hard Money Lenders

- Real Estate Investing Basics: 2 Ways of Real Estate Investment

- Real Estate Basic knowledge: Understanding Real Estate

Popular Page

Private Real Estate Funds - Investments to Drive Income and Capital Growth

Book a Free Complimentary Call

real estate investing Investment Visa USA Investment Magazine Private Real Estate Funds real estate funds