Private REIT vs Public REIT. The risks of Publicly Traded and Non-Traded REITS.

Before considering investing in REITs, you need to know the risks involved.last updated Monday, February 23, 2026

#private reit vs public reit #Risks of Investing in REITs

|

|

by John Burson |

Content Manager, Paperfree Magazine |

QUICK LINKS

AD

Get Access to Real Estate Investment Opportunities

What is REIT?

REITs, or Real Estate Investment Trusts, are investment companies that generate income for the passive investor. REITs own and operate income-generating real estate that is paid in dividends.

REIT and Taxes

REITs are not required to pay corporate income taxes like public companies. Revenue is taxed only after shareholders have received their share. REITs offer a great investment opportunity for investors, as they generate income from real estate. However, there are certain risk factors connected with REITs that you should know before investing.

Before considering investing in REITs, you need to know the risks involved. When investing in REITs through a broker, the broker needs to disclose the risks of the REIT investments.

There are two types of REITs: publicly traded and Non-traded REITs. Each one has a set of risks.

What is Public REIT?

A REIT, or Real Estate Investment Trust, is an investment vehicle that owns and operates income-generating real estate. REITs must distribute at least 90% of their taxable income to shareholders as dividends, making them an attractive investment for those seeking a steady income stream.

Public REITs are traded on stock exchanges, allowing investors to buy and sell their shares like any other publicly traded company.

What is a Private REIT?

Private REITs are not traded on stock exchanges and are typically only available to accredited investors.

Risks of Publicly Traded REITs, Public REITs.

- Leverage Risk.

When an investor borrows money to purchase securities, the leverage risk surfaces. Using leverage causes the REIT to incur additional expenses and increases the fund’s losses due to the underperformance of its underlying investments. The other costs associated with the loan or borrowing will reduce the amount of money available for distribution to the company’s shareholders. - Market Risk.

REITs trade on major stock exchanges and thus are subject to market price fluctuations. This implies that investors may receive less than they paid when they sell their shares on a public exchange. Other market risks are recession, natural disasters, and changes in interest rates.

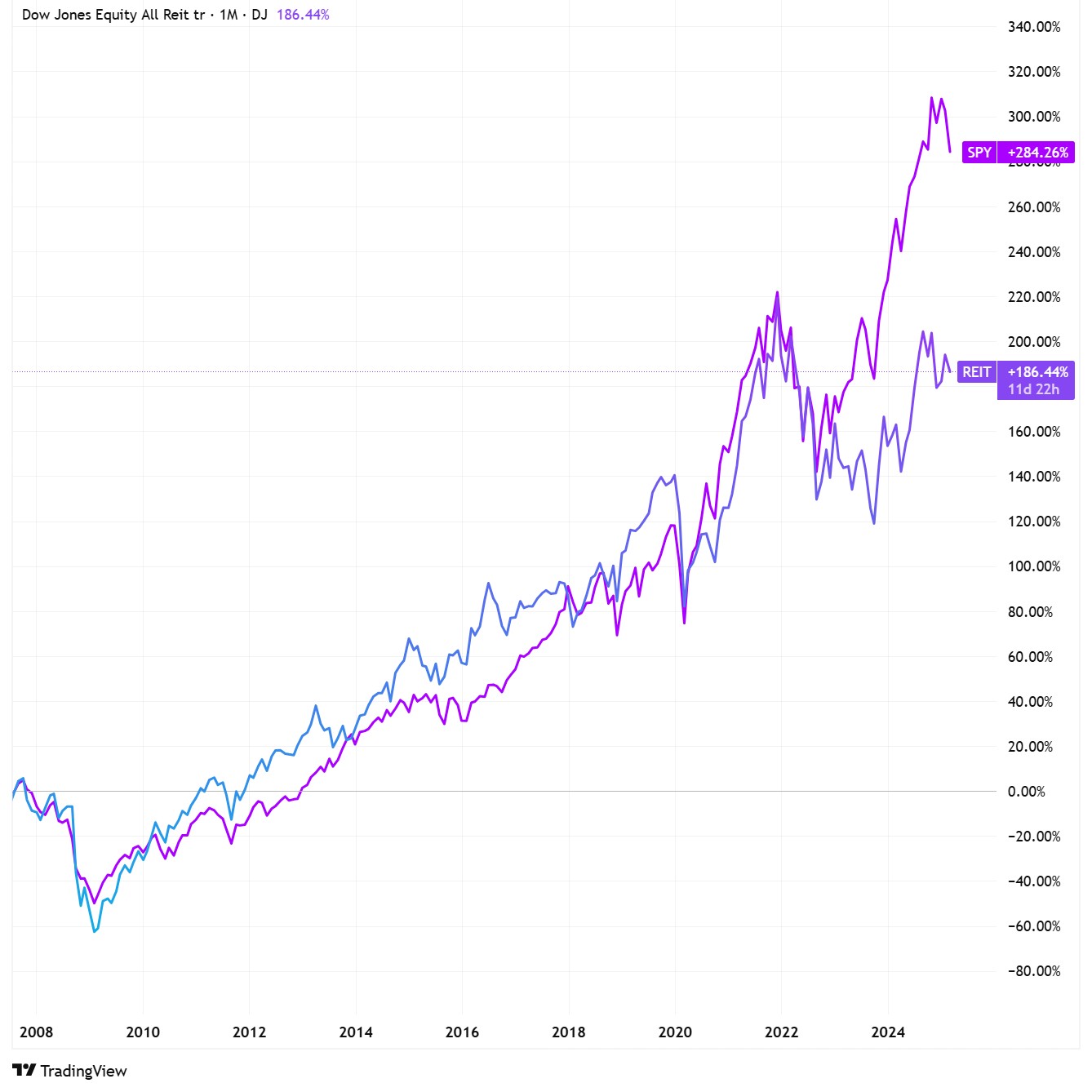

REIT Average & Historical Returns Vs. U.S. Stocks

Fig 1. REIT vs SPY historical performance 2008 - 2025 - Interest Rate Risk.

When interest rates rise, investors look for safe income plays, such as the U.S. Treasury. Treasuries pay a fixed rate of interest and are guaranteed by the government.

Therefore, when the rate rises, REITs sell off, and the bond market rallies as investment capital flows into bonds. This reduces the demand for REITs in the market. - Tax Treatment.

REIT dividends are taxed as ordinary income, which means the regular income tax rate is similar to the investor’s income tax rate. These taxes are likely higher than dividend and capital gains taxes.

Risk of Non-Traded REITs. Private REITs.

- Liquidity Risk.

Non-traded REITs allow investors to sell their shares on public exchanges. Despite the allowance, the investments are illiquid compared to other assets, such as bonds and stocks. There isn’t a secondary market for seeking buyers and sellers for the property you would invest in. Also, liquidity is only provided through the fund’s repurchase offers. There is no guarantee that shareholders who withdraw their investments will be able to sell all or any part of the shares they wish to sell. For liquidity reasons, investors may be unable to convert stocks into cash whenever needed. - Share Value.

Non-traded REITs aren’t publicly traded, so the investors won’t be allowed to research their investments. As a result, determining the value of REITs becomes relatively complex. Some non-traded REITs reveal all assets after 18 months of offering, but it’s pointless. - Upfront Fees.

The upfront fee is charged between 9% and 15%. Apart from an upfront fee, non-traded REITs may also charge external manager fees. Hiring an external manager reduces investor returns. If you choose to invest in such REITs, it’s better to ask the management all the essential questions before you invest.

Investing in REITs can be a passive way to generate income rather than buying a property directly. However, investors should also remember not to be influenced by higher dividend rates since REITs can perform poorly in the market even if the interest rate rises.

Pages Related to #private reit vs public reit

- Invest into real estate funds that help investors to diversify investment portfolios.

- Real Estate Investing Basics: 2 Ways of Real Estate Investment

- Are REITs safe investment? REIT risks explained. Mortgage REIT risks.

- Investing in REITs vs Rental Property. Comparison Between Direct Real Estate Investment vs REITs.

- The Comparison of REITS, Real Estate Funds and Real Estate Mutual Funds.

- Best REITs to Invest In: Top Picks for 2026 and Why You Should Consider Them

- REIT Sector Performance Q3 2025: Data Centers & Industrial Lead Recovery

- Digital Infrastructure Investments 2025: Funding the Future of Connectivity

Popular Page

Private Real Estate Funds - Investments to Drive Income and Capital Growth

Book a Free Complimentary Call

real estate investing Investment Visa USA Investment Magazine Private Real Estate Funds real estate funds