EB5 Investment Projects - Guide | Direct and regional center investment projects

EB 5 investment projects serve to streamline U.S. residency for qualified foreign investors and stimulate economic growth in this country. Get answers to all pertinent questions about this special EB visa program from Paperfree.com.last updated Wednesday, December 24, 2025

#eb5 investment projects #eb 5 investment projects

| | by Sidra Jabeen | Content Manager, Paperfree Magazine |

QUICK LINKS

AD

Get Access to EB 5 Investment Visa Resources

The United States of America has been a reputation for being the land of opportunity since its inception. It has also been the land of immigrants since the mid-1500s. In the financial world, few investment opportunities embody the spirit of inclusiveness, unlike the EB-5 Immigrant Investor Program, which provides a remarkable avenue for foreign investors to gain permanent U.S. residency.

As a result of blending entrepreneurship and immigration, EB5 investment projects have a successful history of fostering economic growth, job creation, and cultural diversity in this country.

On this page, we will answer:

- What is an EB-5 investment project?

- Foreign Direct Investment and Regional Center investments for the EB5 visa program?

- What are the main requirements for EB-5 investment visa program USA?

- How much investment is needed for EB-5 projects?

What is an EB-5 Investment Project?

An EB-5 investment project is a U.S. government program administered by the U.S. Citizenship and Immigration Services (USCIS). Under this program, foreign investors and their immediate family can qualify for lawful permanent residence (Green Card) if they complete the following requirements.

- Invest in a commercial enterprise in the United States

- Have the strategy to create or preserve ten permanent full-time jobs for qualified American workers.

The EB-5 Program’s title refers to the employment-based fifth preference visa for qualified foreign investors. Congress established it in 1990 [1] as a stimulus for job creation and as an outlet for capital investment by foreign investors. In addition, Congress launched the Regional Center program in 1992.

The Regional Center Program sets aside EB-5 visas for participants investing in commercial businesses tied to regional centers. For this reason, the USCIS bases its approval of Regional Center applicants on their proposals for promoting regional economic growth.

Browse EB5 Investment Projects List

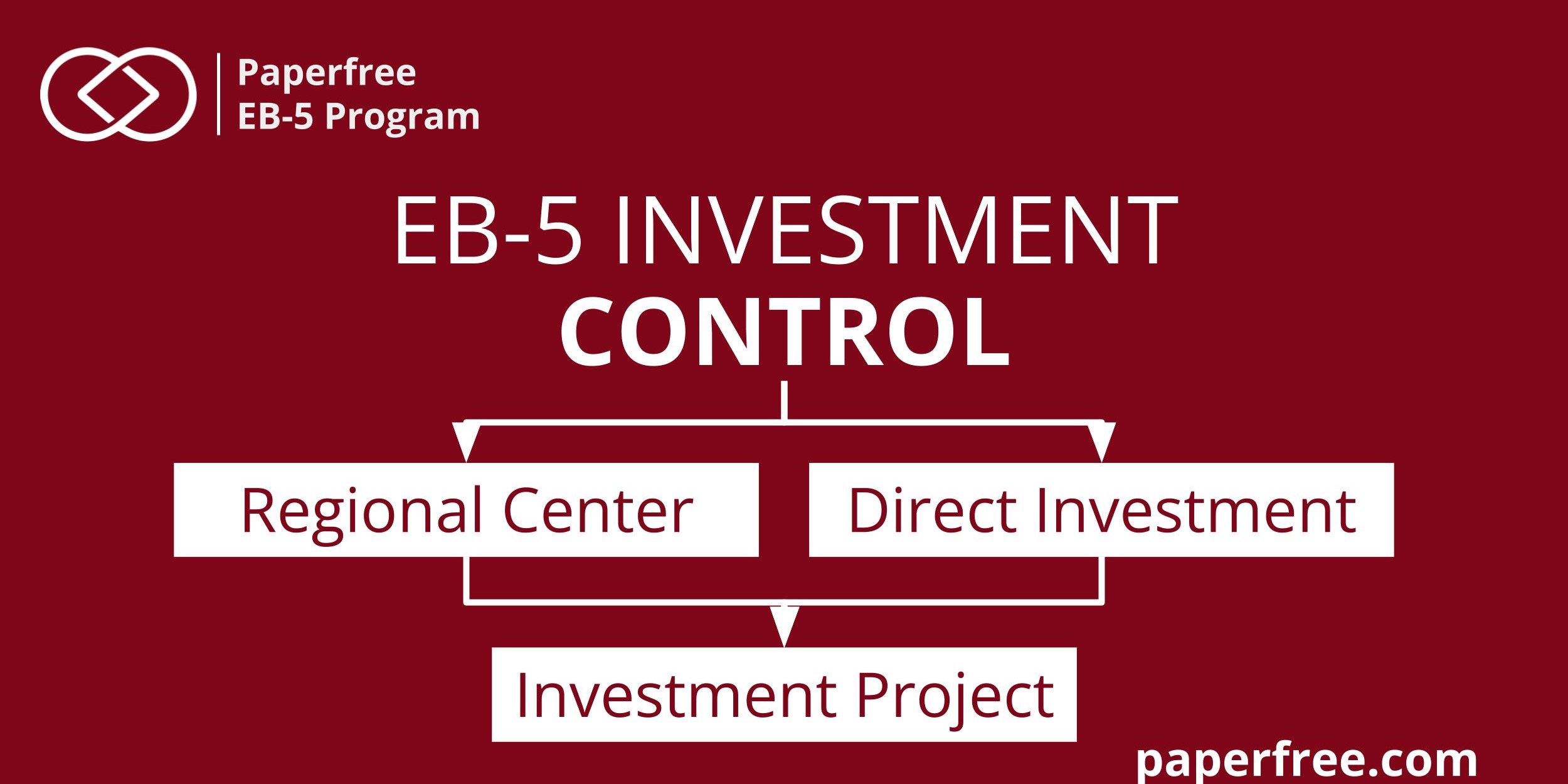

EB 5 Investment Options: control of investment.

The EB-5 Visa Project gives participating investors two options:

- EB5 Investment through Regional Center.

A participant can invest through a Regional Center that gathers funds from several investors to create large-scale projects. After the investment is executed, the participant has no control over capital. - EB5 Direct Investment Projects.

A participant can invest directly without any intermediaries. After the investment is executed, the participant has no control over capital.

What is Foreign Direct Investment?

An EB-5 direct investment project, also known as an FDI, allows the applicants to invest in any commercial enterprise project they choose, provided the project does not involve a Regional Center. The USCIS defines a new commercial enterprise (NCE) as any for-profit activity established for ongoing business operations. Eligible enterprises may include:

- Joint Ventures

- Corporations or Holding Companies

- Sole Proprietorships

- Business Trusts

- Partnerships. Limited or general.

- Private or public-owned entities [1]

Learn more about Direct Investments in the following video. ,"

What is a Regional Center?

Regional Centers are like real estate and private equity funds. They pool capital from multiple U.S. and foreign investors to fund large projects like retail centers, hotels, ski resorts, office buildings, and multi-family rentals.

To qualify for the EB-5 Program, a Regional Center must receive annual approval from the USCIS. Failure to submit the required information to the USIS or to verify progress in promoting economic growth will result in the Regional Center losing approval.

Learn more about EB-5 Immigrant Investor Regional Centers

EB 5 Direct Investment vs Regional Center Projects

| EB5 Investment with Reginal Center vs Direct Eb5 Investment | |

|

EB5 Direct Investment |

EB5 Regional Center Investment |

| Return on Investment | |

| EB-5 Investment Project applicants making direct investments have unlimited earning potential. However, foreign direct investments carry higher risks since the applicant's earnings solely depend on the project's success. | Regional Centers protect investors' capital by creating low-risk projects, generally earning about 0.5% - 4/% annually. |

| Investor's Engagement | |

| FDI participants have complete autonomy over business management decisions that directly or indirectly affect daily operations. | Investors in Regional Center projects play a passive role with no business decision-making powers. This is because Regional Center investors are among the many project members who rely on the Regional Center's investment strategy and structure. |

| Accountability | |

| Since foreign direct investors don't have an intermediary, they are solely responsible for providing documentation from the planning stage and throughout the project. | Regional Center investors primarily rely on the Regional Center to prepare project documentation. This arrangement can be an asset or a liability for Regional Center investors. For example, If the USCIS takes away a Center's approval, the investors' pending petitions will be declined, and they will have to start over. However, a Regional Center investor with a conditional EB-5 visa is safe from losing it. |

| The Size of the Market | |

|

EB 5 Direct Investment projects account for only 10% of the EB5 investment market value. Since this strategy is inactive in the EB5 investment marketplace, investors must build their opportunities pipeline. Please find the active - eb5 direct investment projects. |

EB5 Regional Center Investments are responsible for approximately 90% of all EB-5 visa investments, making it the most popular approach. |

|

EB5 Investment Opportunities |

|

|

Navigate to the investment marketplace |

Navigate to the investment marketplace |

| EB-5 investment exit strategy | |

| refinancing |

return of capital to investors |

Related content: EB-5 Immigrant Investor Regional Centers

Video: Direct EB-5 Investment Vs. Regional Center EB-5 Investment

EB5 Investment Options, by type of investment projects

The EB-5 Visa Project gives participating investors a few options to participate in EB5 Programs:

- EB5 real estate projects

Any project where EB5 real estate investment is the primary investment strategy.

- EB5 real estate development

Foreign investors can finance real estate development projects like hotels, retail centers, office buildings, ski resorts, and multi-family rentals.

- EB5 real estate development

- EB5 business investment projects

- Option: Foreign investors can buy existing businesses to scale.

- Option: Foreign investors can start a new business.

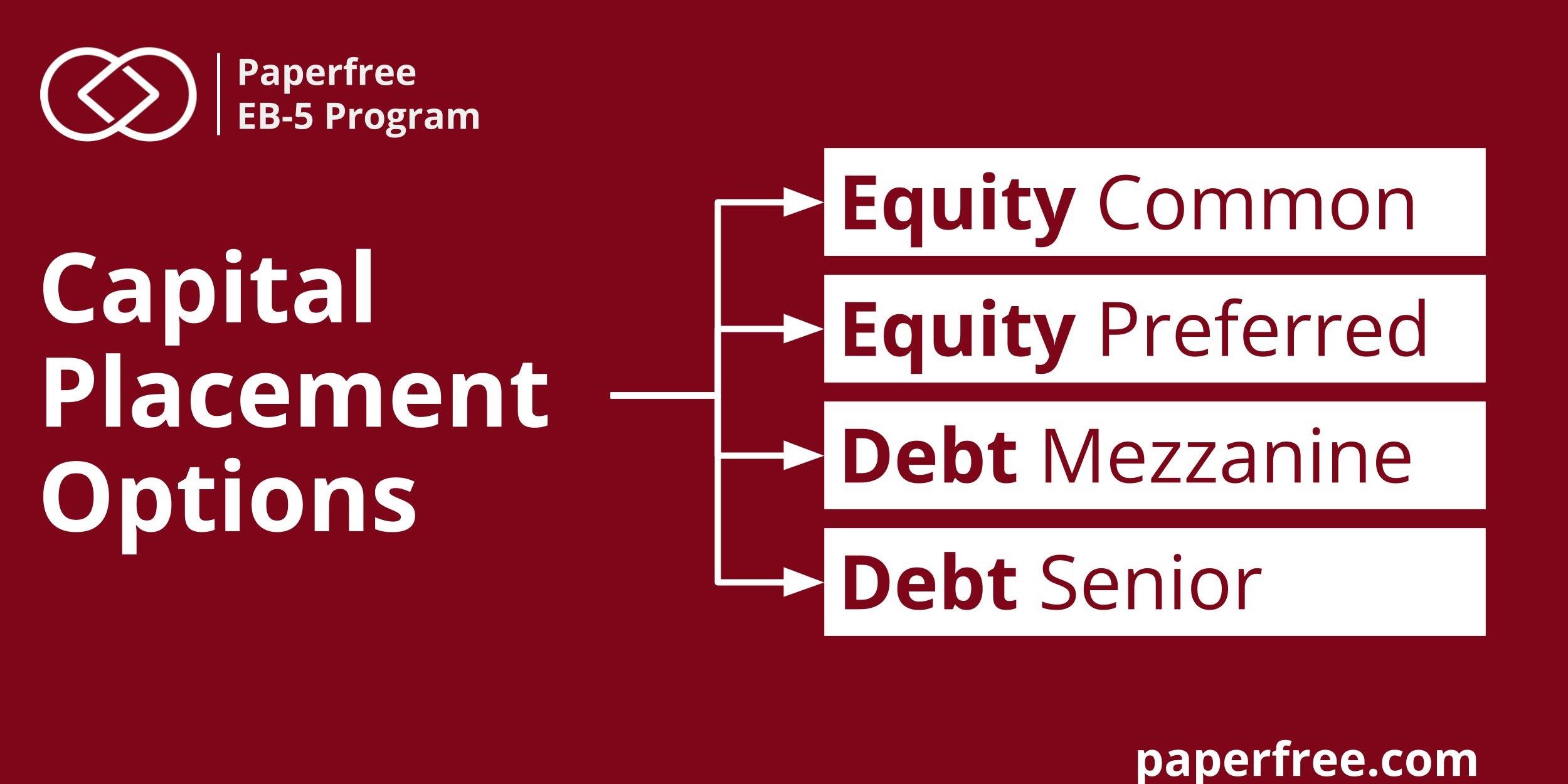

EB-5 Capital Structure Options

The most common investments are made in Preferred Equity, but there are some investment opportunities where EB 5 investors can secure a position on the debt part of the capital stack.

EB5 Projects Requirements

Requirements for the Source of Investment Capital

USCIS defines capital as all real, personal, or mixed tangible assets owned or controlled by the immigrant investor [1].” It evaluates all capital at fair-market value in U.S. dollars.

According to USCIS, its definition of capital disqualifies the following.

- Assets directly or indirectly acquired by criminal activity or other illegal means.

- Debt-based assets include notes, convertible debt [2], bonds, or debt drafted between the immigrant investor and the new commercial enterprise (NCE).

- Invested capital with a guaranteed rate of return matching the amount invested.

- Invested capital stems from any agreement between the project participant and the new commercial enterprise that contractually entitles the immigrant investor to repayment.

As part of the application process, foreign investors must present documented proof that they are the legal owners of the capital invested.

Requirements for the Investment Amount for the EB-5 Projects

The Tier 1 investment. When the investment project is located in any US market for Direct or Regional Center program participants, it is $1,050,000.

The Tier 2 investment. Applicants must designate $800,000 for the Target Employment Area (TEA) [1]. A targeted employment area can be a rural area or an area with unemployment of at least 150% of the national average unemployment rate [1].

| Non-Target Employment Area | Target Employment Area |

| $1,050,000.00 | $800,000.00 |

Learn more EB 5 investment amount and total cost of EB 5 visa.

Requirements for the New Job Creation

The EB-5 Investment Project requires program participants to hire ten full-time employees through direct and Regional center investments. FDI participants must officially hire employees for positions in the formed company, including the investors and their family members. On the other hand, Regional Center investors can include indirect and induced jobs as additions to or substitutes for direct employment, such as a contractor or supplier company.

EB5 investment options

- EB 5 projects California, Invest in 8th Largest Economy in the World

- EB 5 projects in New York City

- EB-5 Projects in Florida | Paperfree

- EB5 Real Estate Investment Projects as a strategy to protect against inflation.

- EB5 Infrastructure Projects

- USCIS approved EB5 projects. EB5 projects approval process.

- EB5 direct investment projects

- Rural EB-5 Projects for foreign investor looking for expedited processing.

- EB 5 Projects in Texas | Texas Regional Center EB-5 Projects for Investors

Frequently Asked Questions

How can Paperfee.com help EB-5 Investment Project participants?

Paperfree.com is an investment platform that can become your hub for EB-5 visa information and EB5 Visa project investment opportunities sponsored by vetted Regional Centers.

Vetted EB5 investment projects

We share a group of funds and private equity investment opportunities with the USCIS qualifying factors, risk-mitigating strategies, and potential for greater-than-average returns. Sign up for all the news, insights, and deals to boost your investment potential.

Sources

[1] USCIS.gov Working in the US. https://www.uscis.gov/working-in-the-united-states/permanent-workers/employment-based-immigration-fifth-preference-eb-5/about-the-eb-5-visa-classification

[2] Convertible Debt/UpCounsel https://www.upcounsel.com/convertible-debt

Pages Related to #eb5 investment projects

- EB 5 investment projects list USA

- EB5 Investment Visa Guide 2025

- History of EB-5 Program - An Outlook For Investors

- EB5 Processing Time: A Journey Towards Green Card 2026 | Paperfree.com

- EB-5 Investment Repayment| Exit Strategies and Financial Returns

- 15th Annual IIUSA EB-5 Industry Forum Houston, TX : Strategic Insights for 2025

- EB5 direct investment projects

- EB-5 Visa Real Estate Investment Path: Paperfree 2025-2026 Insights

Popular Page

Benefits of the EB-5 Visa Program| A Comprehensive Guide

Book a Free Complimentary Call

real estate investing Investment Visa USA Investment Magazine Private Real Estate Funds real estate funds