EB-5 Banking in 2025: The Ultimate Guide to Best Banking Solutions for Regional Centers

Elevate your EB-5 Regional Center's financial strategy with specialized banking solutions. Uncover proven approaches for seamless and successful EB-5 banking ventures. Navigate the complexities of financial management with precision and confidence.last updated Friday, April 11, 2025

#EB-5 Banking #EB-5 bank

| | by Sidra Jabeen | Content Manager, Paperfree Magazine |

QUICK LINKS

AD

Get Access to EB 5 Investment Visa Resources

Key Points:

- Diversify EB-5 funds across multiple banks to ensure FDIC coverage for deposits exceeding $250,000.

- Use third-party banking solutions like deposit sweep services to manage funds efficiently and guarantee FDIC protection.

- Partner with banks experienced in EB-5 regulations to ensure compliance and investor protection.

- Choose flexible banking solutions that allow quick fund transfers and adjustments during financial uncertainties.

- Take advantage of favorable interest rates to maximize returns on investor capital.

- Maintain multiple banking relationships to mitigate risks and ensure operational redundancy.

- Adhere to regulatory requirements such as AML, KYC, and OFAC to foster trust and secure smooth banking operations.

Introduction

The EB-5 visa program offers a unique opportunity for investors seeking U.S. residency by contributing to the economy. However, navigating EB-5 banking can be complicated, especially regarding safeguarding investor funds and complying with regulatory requirements. Finding the right banking partner is critical—a decision that can influence the success of an EB-5 Regional Center and the stability of investor funds.

This comprehensive guide explains the essential aspects of EB-5 banking, including the optimal approaches for choosing a bank, understanding regulatory requirements, and building strong relationships with your banking partners. We’ll also answer frequently asked questions to help you manage EB-5 investments confidently in 2025.

The Importance of EB-5 Banking: Safeguarding Investor Funds

EB-5 investors put their capital at significant risk—not only financially but also in terms of their immigration goals. If funds aren't allocated appropriately to job-creating activities, investors can lose their capital and their chance at permanent residency in the United States. Therefore, the right banking arrangements are crucial.

In light of recent bank failures in 2023, such as those of Silicon Valley Bank (SVB) and Signature Bank, EB-5 stakeholders face increased concerns about financial safety. This is especially important when deposit amounts exceed the FDIC-insured limit of $250,000. Without additional safeguards, investors could lose uninsured quantities in the event of a bank failure. As of 2025, maintaining proper FDIC-insured accounts is no longer just a best practice but a critical necessity.

Key Challenges for EB-5 Stakeholders

Why Are EB-5 Stakeholders Vulnerable?

Three of the four largest bank collapses in U.S. history occurred within the last few years. Interestingly, these banks shared similar characteristics: regional banks specializing in niche industries, including EB-5 deposits. This leaves EB-5 stakeholders uniquely vulnerable, mainly because these banks catered to industry-specific needs rather than broader customer bases.

Despite the potential safety of larger banks, many EB-5 investments continue to be placed with regional banks due to specialized service offerings and personalized attention. The question then becomes: how do we navigate the increased risk?

Best Banking Solutions for EB-5 Regional Centers

To help mitigate these risks, EB-5 Regional Centers should adopt a more diversified and strategic approach to managing funds.

Here are some of the best banking strategies for EB-5 Regional Centers in 2025:

1. Diversify Across Multiple Banks

Instead of depositing the entire EB-5 capital in one bank, distribute funds across multiple financial institutions. By leveraging various bank accounts, each investor's funds can benefit from the full FDIC insurance coverage of $250,000 per depositor, per institution. This ensures that investor funds are not at risk if a single bank fails.

2. Utilize Third-Party Banking Solutions

Third-party banking solutions offer a way to manage funds across multiple institutions efficiently. A "deposit sweep solution" or engaging an independent third party can facilitate spreading deposits, ensuring full FDIC coverage. Such solutions also provide flexibility, allowing funds to be moved quickly if needed, thus providing an extra layer of security.

3. Partner with Banks Experienced in EB-5

Regional banks with a specific understanding of EB-5 regulations can offer customized banking products that ensure compliance with USCIS guidelines. These banks often provide escrow services, special reporting, and experience dealing with foreign currency, which are critical for maintaining EB-5 investor confidence.

4. Opt for Flexible Banking Solutions

Flexibility is key. Investors need to know that their funds are being used to create jobs—as per USCIS requirements—but they also need assurance that their deposits are safe. A banking solution that allows for easy movement of funds between institutions or quickly reallocates money during financial uncertainty is crucial for meeting these needs.

5. Take Advantage of Interest Rate Opportunities

Many regional centers now allocate investor funds to institutions that offer favorable interest rates. This secures the funds and maximizes returns, potentially offering better loan terms for EB-5 projects.

Reducing Risk and Protecting Investor Funds

A well-thought-out banking strategy helps reduce risk and secures investor confidence. Below are the top considerations for Regional Centers:

- Ensure FDIC Coverage: Ensure that every investor’s deposit does not exceed the FDIC-insured limit at any single institution.

- Collaborate with Trusted Banking Partners: Choose financial institutions that are transparent and experienced in EB-5 investments.

- Build Redundancy: Maintain multiple banking relationships to mitigate the risk of failure or abrupt policy changes.

- Establish Clear Protocols for Crisis Management: Have clear plans to transfer funds if a bank shows financial instability.

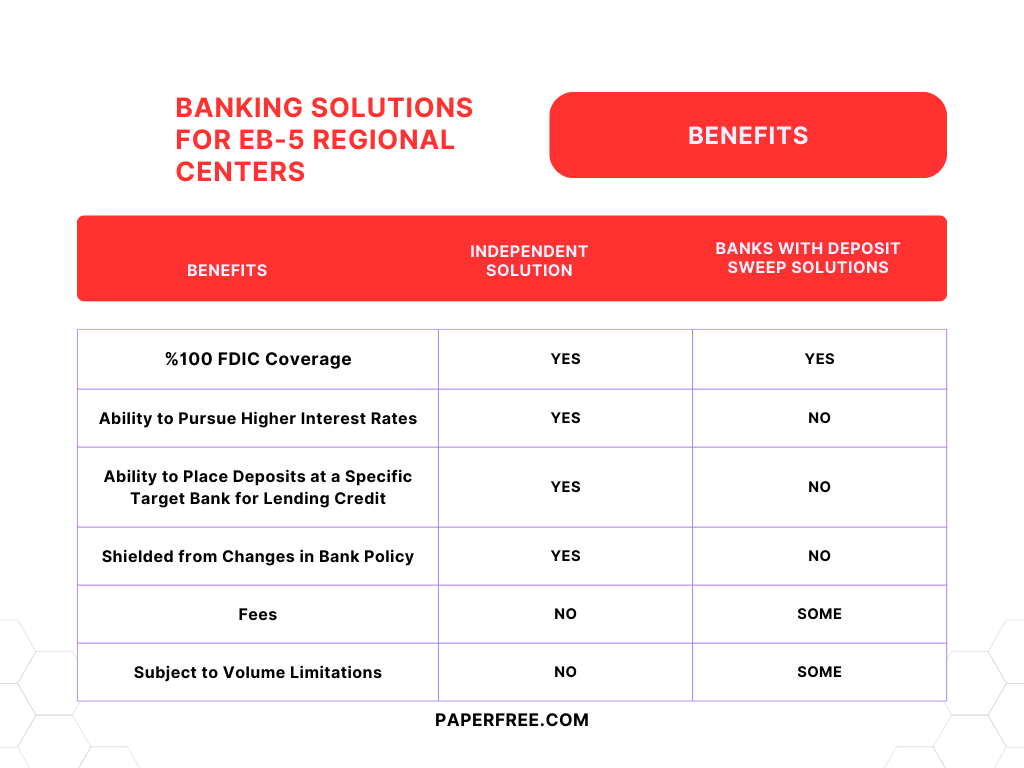

Fig: Best Banking Solutions for EB-5 Regional Centers

Bigger Bank Isn’t Always Better

While larger banks may have a better chance of weathering a financial crisis, regional banks are often preferred for EB-5 deposits. Why is this the case, and what steps can be taken to reduce risk and reassure investors about the security of their funds?

To safeguard investor cash, it is essential to understand what a bank must have to accept EB-5 deposits, the risks involved, and how to provide investors with flexibility. This approach minimizes potential issues and enhances confidence.

In contrast to their larger counterparts, regional banks are motivated to acquire additional deposits, making them more willing to invest time and resources into understanding EB-5 regulations. They can establish specialized departments or services focusing on industries like EB-5, allowing them to differentiate themselves from larger banks. This specialization should be viewed as a strength by investors.

In the complex world of EB-5, regulatory compliance is critical. Regional banks with a deep understanding of EB-5 programs can assure investors that their funds will be released when necessary and will not be distributed in a way that violates EB-5 regulations—something larger banks may not always guarantee.

Although regional banks may carry higher levels of risk due to their high leverage ratios, FDIC insurance generally mitigates this risk for everyday depositors. But what about investors who deposit amounts exceeding the FDIC maximum of $250,000?

Third-Party Banking Solution

As mentioned, the FDIC guarantees each depositor’s funds up to $250,000 at a single financial institution. However, if an EB-5 account is set up correctly, each investor is entitled to the full $250,000 of FDIC insurance at each participating financial institution.

To ensure no investor exceeds the $250,000 FDIC limit, it may be necessary for an investor to have accounts at four or more banks. While this could be a logistical challenge for regional centers, partnering with banking and escrow providers who can manage these complexities ensures transparency and constant visibility of where each investor's assets are placed.

A system of reciprocity, used by a group of participating banks, allows investor deposits to be distributed among them, ensuring complete FDIC coverage. This is known as a "deposit sweep solution." However, this system may be limited in terms of participating banks, thus restricting the Regional Center's choices. Additionally, banks often incur fees to participate in deposit sweep programs, which may be passed on to depositors.

An alternative is an independent deposit option. Third-party providers, which are not tied to specific banks, can work with institutions trusted by Regional Centers, providing more flexibility in where to place investor funds. This approach also allows Regional Centers to leverage higher interest rates or negotiate better EB-5 loan terms by directing deposits to specific financial institutions based on their priorities.

Protecting Against Bank Failures

While deposit sweep and independent solutions ensure full FDIC coverage, independent solutions give depositors more control over their funds. Investors can quickly transfer their funds between institutions if circumstances change, offering added flexibility and protection against potential bank failures.

Five Approaches to Successful EB-5 Banking

Many EB-5 project sponsors struggle with banking complexities due to a lack of understanding of how banks operate within this space. This article highlights critical banking challenges and provides five actionable approaches to ensure a smooth and successful partnership.

1. Reframe Your Approach to Banks as Escrow Agents

Unlike traditional business negotiations, EB-5 banking requires a different mindset. Here’s why:

- Limited Options

The pool of banks willing to accept EB-5 escrow accounts is small. An aggressive approach may backfire and eliminate the possibility of securing a partner altogether. - Building Trust Wins

Think in terms of partnership, not negotiation. Banks prioritize security and investor protection. You earn their trust by demonstrating transparency, providing thorough documentation, and adhering to regulations.

Benefits of a Good Relationship:

- Faster Sales

Investors feel secure knowing their funds are handled by a reputable bank, enabling quicker sales. - Smoother Transactions

Trust leads to better communication and streamlined processes. - Long-Term Partnership

Building goodwill helps foster future collaborations.

Look for a bank that:

- Has a solid reputation and financial stability.

- Knows EB-5 or partners with experts in the field.

- Prioritizes investor protection, aligning with your values.

By prioritizing collaboration and trust, you can secure an escrow account and form a long-term partnership that supports your EB-5 project’s success.

2. Plan Ahead

EB-5 sponsors must understand and plan for investor nationalities and currency restrictions challenges. Here’s how:

- Country Restrictions

Many banks have internal lists of high-risk countries that may limit investor participation. Discuss your target nationalities with potential banking partners early on. - Currency Restrictions

Be mindful of countries with restrictions on fund transfers, which could affect wire transfers. Speak with your bank about handling currency conversion and ensuring smooth transactions. - FBO Wires and Alternatives

Some banks disallow FBO (for the benefit of) wires. Be prepared to discuss alternative solutions, such as direct transfers from investor accounts or alternative wire services.

Key Takeaway: Early, open communication with your bank about investor demographics and potential currency restrictions is essential for smooth transactions.

3. Plan the Capital Stack Carefully

With increasing I-526 processing times, EB-5 projects may struggle to secure capital quickly. While "early release" escrow structures seem appealing, aligning them with the project timeline may be difficult. Bridge financing offers a solution:

- The Challenge

Traditional escrow structures hold funds until I-526 approval, delaying project progress. - The Bridge Solution

Secure bridge or mezzanine loans to access capital earlier. Repay the bridge loan with EB-5 funds once I-526 approval is granted.

Benefits of Bridge Financing:

- Faster Fundraising

Access capital promptly to accelerate project progress. - Flexible Escrow

Negotiate better escrow terms that align with project timelines. - Reduced Risk Perception

Show banks alternative funding sources to mitigate concerns.

By leveraging bridge financing, EB-5 projects can access funds sooner and enhance investor confidence, helping to ensure smooth project execution.

4. Comply with Document Requests Swiftly and Completely

The EB-5 program is under increasing scrutiny, and banks are adjusting to new regulations. While these adjustments may feel burdensome, understanding their purpose can help facilitate smoother partnerships:

- Heightened Regulation

Banks face increasing pressure from regulatory bodies like AML, BSA, and OFAC. This means evolving rules and more thorough documentation requests. - Transparency

Prepare for extensive KYC (Know Your Client) checks and provide all necessary project and investor documentation. - Compliance is Key

Risk and compliance officers are the decision-makers, and non-compliance is not an option.

How to Proactively Partner with Banks:

- Start early in the process.

- Be transparent with all necessary documents.

- Stay informed about changing regulations.

- Foster a collaborative relationship based on open communication.

By understanding and addressing regulatory requirements early, you can build stronger relationships with banks and ensure smoother transactions for your EB-5 project.

5. Maintain a Central Repository of Documents

The complexity of EB-5 projects demands careful record-keeping. A centralized system for all project-related documents ensures compliance and helps maintain transparency.

Final Thoughts: Adapting to the Future of EB-5 Banking

EB-5 banking requires a fine balance between safeguarding investor funds and meeting the specific compliance needs of the EB-5 visa program. As we move into 2025, staying updated on financial regulations and choosing the right partners can make a world of difference in the success of an EB-5 project. Diversification, strategic planning, and strong relationships with banking institutions are all critical components for ensuring that both investor funds and immigration opportunities remain secure.

For EB-5 Regional Centers, the lessons learned from recent banking failures emphasize the need for proactive measures—and these strategies represent your best path forward in ensuring the continued success of your EB-5 projects.

Book Your Free Consultation with Paperfree EB-5 Visa Experts. Get Personalized Advice and an Investment Plan. Book Your Free Consultation Today!

Frequently Asked Questions (FAQs)

1. What are the key factors to consider when choosing an EB-5 bank?

When choosing a bank for EB-5 projects, consider its experience with the EB-5 program, including its ability to manage escrow accounts that comply with EB-5 regulations. The bank should also have a solid understanding of AML (Anti-Money Laundering) and KYC (Know Your Client) rules. Other factors to consider are the bank’s fees, interest rates, and overall reputation for handling investor funds securely.

2. What banking services do EB-5 regional centers typically need?

EB-5 regional centers generally require various banking services, including secure escrow accounts for investor funds, operating accounts for project management, and international wire transfer capabilities to handle global investors. Depending on the project, regional centers may also need access to bridge loans or other financial solutions to facilitate capital flow.

3. Are there any regulatory considerations specific to EB-5 banking?

Yes, EB-5 banking is heavily regulated by multiple U.S. agencies, including FinCEN (Financial Crimes Enforcement Network) and OFAC (Office of Foreign Assets Control). The bank you choose must be well-versed in these regulations to ensure full compliance with AML, KYC, and other legal requirements.

4. What documents are required when seeking EB-5 banking services?

When applying for banking services related to the EB-5 program, you must provide documentation that includes your business plan, financial projections, offering materials, and detailed information about investors. Be prepared for additional documentation requests based on your specific project or investor situation.

5. How can I build a strong relationship with my EB-5 bank?

Building a strong relationship with your EB-5 bank involves maintaining clear and open communication. Be responsive to their requests for documentation and updates, and ensure transparency about the source of funds. Trust is essential, so demonstrating a commitment to regulatory compliance and investor protection will strengthen the partnership.

Additional Resources:

- IIUSA: The EB-5 Industry Association: https://iiusa.org/

- EB-5 Investment Review: https://eb5visainvestments.com/testimonial/

- U.S. Citizenship and Immigration Services (USCIS): https://www.uscis.gov/

Remember, choosing the right bank is essential for your EB-5 project. By carefully considering your needs, conducting thorough research, and building solid relationships, you can find a banking partner to support your success for your EB-5 Loans with the right banking solutions.

Pages Related to #EB-5 Banking

- Papefree EB5 investors magazine your source for EB5 insights. EB5 News.

- EB5 Investment Visa Guide 2025

- History of EB-5 Program - An Outlook For Investors

- July 2025 Visa Bulletin: EB-5 Investment Visa Program Shows Positive Movement

- EB-5 for Tech Entrepreneurs: Immigration Program for Startup Founders | Paperfree

- EB-5 Regional Center Program 2027 Expiration: Secure Your Green Card Before Deadline | Renewal Updates

- EB-5 Investment Protection: How Experienced Developers Safeguard Your Capital | Paperfree

- Top 10 EB-5 Investor Countries Markets

Popular Page

Benefits of the EB-5 Visa Program| A Comprehensive Guide

Book a Free Complimentary Call

real estate investing Investment Visa USA Investment Magazine Private Real Estate Funds real estate funds