What is EB 5 Investment Amount and Total Cost of EB 5 Visa?

Understanding the EB-5 Visa Cost: A Comprehensive Breakdownlast updated Friday, April 11, 2025

#eb 5 investment amount #eb5 investment amount

| | by Sidra Jabeen | Content Manager, Paperfree Magazine |

QUICK LINKS

AD

Get Access to EB 5 Investment Visa Resources

Becoming a US Permanent Resident through the EB-5 investor visa program has specific requirements, one of which is the investment amount. In this article, we will cover different investment categories and minimum amounts, the future minimum potential quantities, frequently asked questions, and EB-5 visa processing costs as of August 2024.

EB-5 Visa Processing Costs (2025)

Depending on your filing location, an EB-5 investor visa costs between $4,000 and $4,900. Remember that the cost of an EB-5 visa varies from case to case.

Form I-526 Filing Fee: The Form I-526, Immigration Petition by Alien Entrepreneurs, requires a $3,675 filing fee. If you are an out-of-country applicant, the consular processing fee will be an additional $345, bringing your total to $4,020 before the cost of a medical exam.

Form I-485: If you apply within the U.S., you must pay $1,140 to file Form I-485, the Application to Register Permanent Residence or Adjust Status. Adding the biometrics service fee, your total would be $4,900.

EB-5 Investment Amount at the Project Level

The EB-5 investor visa program has specific requirements, and the most important is the required investment amount. There are two options for the minimum investment an applicant has to make in the sponsored EB-5 investment project:

Option #1: If the sponsored investment project is in a TEA (Targeted Employment Area), the minimum investment required is $800,000.

Option #2: If the sponsored investment project is outside a TEA (Targeted Employment Area), the minimum investment required is $1,050,000.

EB 5 visa minimum investment as of August 2024

|

Minimum |

|

|

Project in Targeted Employment Area |

|

| yes | no |

|

$800,000 |

$1,050,000 |

Download the table as a picture.

.jpg)

Pic. EB5 Amount for 2022, 2023, 2024, 2025, 2026

Estimated EB 5 minimum investments as of 2027

|

estimated minimum |

|

|

Project in Targeted Employment Area |

|

| yes | no |

|

$840,000 |

$1,123,500 |

Download the table as a picture.

Pic. EB5 Amount for 2027, 2028

Understanding EB-5 Investment Capital and Compliance Requirements

Consumer Price Index (CPI)

The Consumer Price Index (CPI) is a vital tool for tracking price changes over time for everyday items. It examines the cost of food, clothing, and household items, providing insight into inflation and purchasing power.

Investment Capital

Investment capital must be owned and controlled by the immigrant investor. All capital is valued at fair-market value in U.S. dollars.

Capital Includes:

- Cash

- Real, personal, or mixed tangible assets

Capital Does Not Include:

- Assets acquired directly or indirectly by unlawful means (such as criminal activities)

- Capital invested in exchange for a note, bond, convertible debt, obligation, or any other debt arrangement between the immigrant investor and the new commercial enterprise

- Capital invested with a guaranteed rate of return on the amount invested

- Capital invested subject to any agreement between the immigrant investor and the new commercial enterprise that provides the immigrant investor with a contractual right to repayment, except that the new commercial enterprise may have a buyback option exercisable solely at the new commercial enterprise's discretion

EB-5 Investment Amounts (2023 and 2024)

The investment amount required in 2023 and 2024 is crucial for applicants to understand the EB-5 investor visa program.

EB-5 Regional Center Investment Amount vs. Direct Investment into EB-5 Projects

From a capital perspective, there is no difference in how much you should invest in a project sponsored directly or by a regional center.

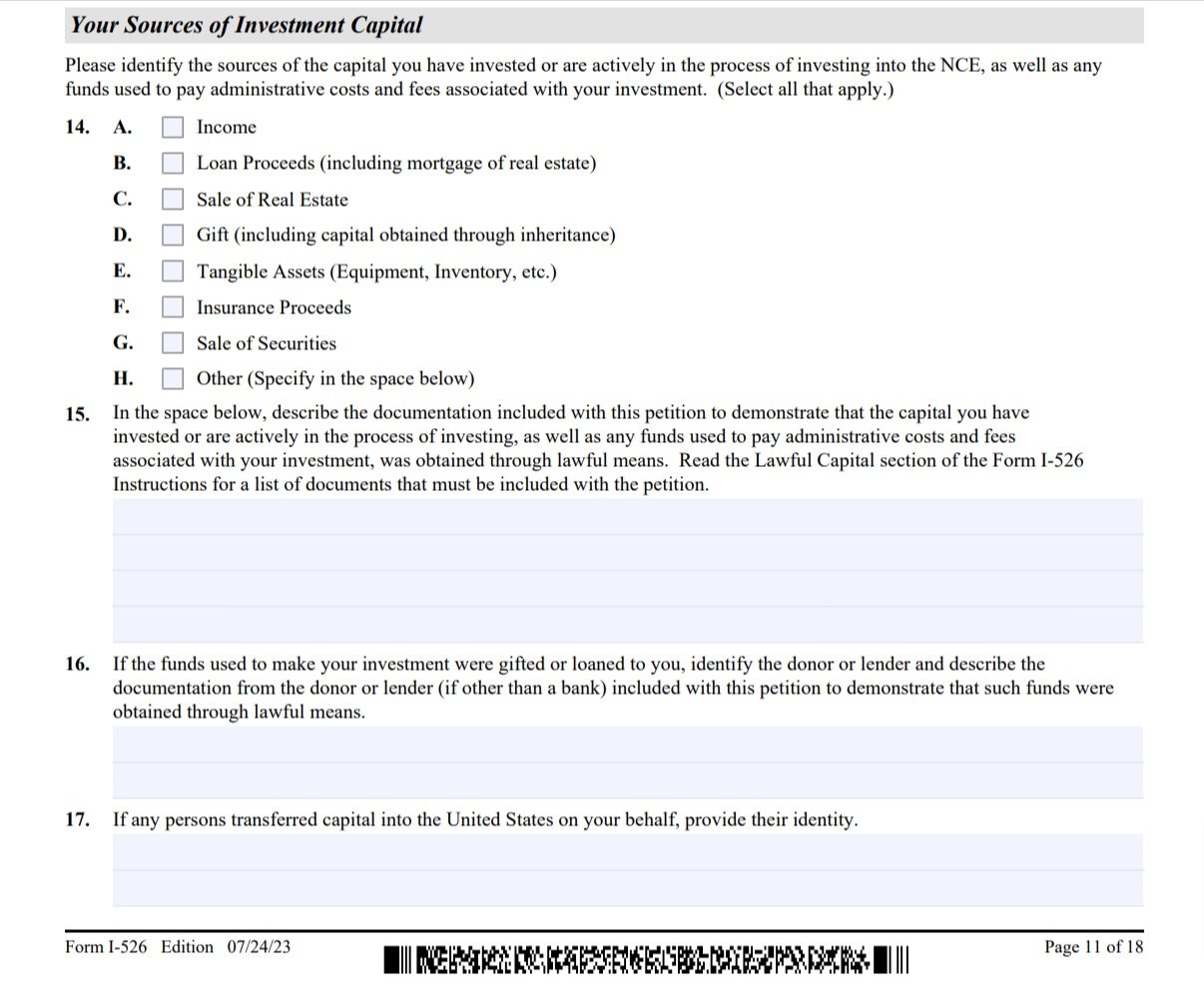

Investment Compliance: Source of Funds

Form I-526 necessitates detailed information about the New Commercial Enterprise (NCE) and thorough documentation regarding the source of the invested funds.

Form I-526 / Source of Investment Capital: Applicants must provide comprehensive documentation to verify that the investment capital was obtained through lawful means. This includes financial records, tax returns, and other relevant documents to substantiate the source of funds.

fig 1 Form I 526 Immigrant Petition Source of Funds

Establishing Lawful Ownership and Source of Funds for EB-5 Investment

The primary objective of this endeavour is to establish that the investor is the lawful owner of the invested capital and that the funds have been acquired through legitimate means, as stipulated in the USCIS Policy Manual.

To support their visa applications, investors can provide a range of documents that can be categorized into four main groups:

-

Business Registration Records:

- These records should include tax returns or similar documents filed within the preceding five-year period for personal, partnership, or corporate entities.

-

Proof of Other Sources of Capital:

- Investors must provide evidence of other sources of capital, detailing how the funds were acquired.

-

Certified Copies of Court Judgments:

- Include any pending civil or criminal court cases and government administrative proceedings in or outside the United States within the past 15 years.

-

Evidence of Administrative Fees:

- USCIS adjudicators frequently request evidence of the source of funds for administrative fees, necessitating comprehensive documentation covering the investment amount and any associated costs.

The requirements for confirming the origin of investment funds are the same for regional center projects and direct investments. Given that investment funds often originate from multiple sources, investors may need to submit various types of documentation.

To streamline this process and ensure clarity, investors should collaborate with EB-5 professionals or immigration attorneys to identify the most straightforward and transparent source of their investment funds. For instance, assets acquired through loans and utilized as collateral to raise the investment amount and funds received from third parties in gifts or loans can lead to intricate sources of fund documentation. Conversely, funds from personal savings and investments typically entail simpler supporting documentation.

The Total Cost of an EB-5 Visa

The cost of an EB-5 Visa depends on various scenarios. The main variables impacting the price are as follows:

- Location of Applicant:

- The cost can vary depending on whether the applicant is inside or outside the U.S. during the first stage of the process.

- Location of the EB-5 Investment Project:

- The investment project's location, whether inside or outside a Targeted Employment Area (TEA), affects the required investment amount.

- Investment Management:

- The cost differs depending on whether the investment is managed directly by the investor or through a regional center investment.

By understanding the EB-5 visa investment amount and preparing the necessary documentation, investors can navigate the EB-5 visa process more effectively. Working with experienced EB-5 professionals or immigration attorneys can provide valuable guidance and ensure a smoother application process.

Below is a table that covers most of the costs associated with the EB 5 Visa to Green Card Process.

| EB 5 Visa Cost | ||

| Amount |

Description | |

| min (TEA) | max (no-TEA) | |

| -$800,000* | $1,050,000 | EB 5 Project Investment |

| -$3,675 | Form I-526 or I-526E Filing Fee | |

| -$325 | $1,140 | Adjustment of Status or Immigrant Visa Application Fee |

| -$50,000 | $70,000 | Regional Center Administration Fee |

| -$15,000 | $20,000 | Immigration Attorney Legal Fees |

| -$2,000 | $10,000 | Documents Translation |

| individual | Tax | |

| individual | Travel Expenses | |

| -$871,000 | $1,154,815 | TOTAL UPFRONT COST |

| +$800,000 | $1,050,000 | Return of Eb5 Project Investment Amount |

| +$200,000** | $262,500** | Potential Capital Appreciation |

| +129,000 | +157,685 | TOTAL EB5 COST |

* EB5 minimum investment amount

** Potential Return on Investment. Based on a 5% annual return assumption.

Frequently Asked Questions (FAQs)

What is the EB-5 visa cost?

The EB-5 visa cost includes an investment amount of $800,000 for Targeted Employment Areas (TEA) and $1,050,000 for non-TEA projects. Additional costs include the Form I-526 filing fee of $3,675, consular processing fees of $345 for out-of-country applicants, and Form I-485 fees of $1,140 plus biometrics service fees if applying within the U.S. Overall, the total EB-5 visa cost can range from $4,000 to $4,900, depending on specific circumstances and filing location.

What are other global investor immigration programs?

The EB-5 Visa program in the USA is one of the most cost-effective golden visa options compared to its global counterparts. For example, Portugal requires a minimum investment of EUR 500,000, while Spain also demands EUR 500,000. Greece offers a more affordable scheme with a minimum investment of EUR 250,000. In contrast, the United Kingdom has a higher threshold with a requirement of GBP 2 million. Ireland sets its minimum investment at EUR 1 million.

How much should I invest for an EB-5 visa?

For an EB-5 visa, it is recommended that you invest a minimum of $800,000 in specific projects. The first step involves picking an investment strategy that best suits your personal immigration and secondary investment objectives. The chosen strategy will dictate the exact amount you need to invest.

How much money do you need for EB-5?

For the EB-5 program, you need a project investment of at least $800,000. Additionally, it would be best if you accounted for third-party fees of at least $100,000 and government fees of at least $15,000.

Is an investment of $500,000 sufficient for an EB-5 immigrant visa?

Actually, more than a $500,000 investment is required. As of March 15, 2022, the minimum EB-5 Visa Investment Amount for the EB-5 Investment Program was increased to $800,000.

How much capital investment is required for EB-5?

The minimum investment required for the EB-5 program is $800,000 for targeted employment areas (TEA) and $1,050,000 for non-TEA projects. There is no maximum investment amount.

How much investment is required for the EB-5 regional center?

The minimum EB-5 visa investment for regional center projects is the same as direct investment, set at $800,000 for infrastructure or targeted employment area projects and $1,050,000 for non-TEA projects.

Do EB-5 investors get their money back?

EB-5 investments do not guarantee a return. Due diligence and assessment of investment risk are essential to ensure informed decision-making.

Can a direct investment in the EB-5 program qualify for the reduced investment amount in a Targeted Employment Area (TEA)?

Yes, direct investment in the EB-5 program can qualify for the reduced investment amount of $800,000 if it is made in a Targeted Employment Area (TEA). A TEA is classified as either a rural area or a location with high unemployment, meeting at least 150% of the national unemployment rate. To qualify, the direct investment must fulfill the TEA criteria at the time of the investment. It is essential to verify the area’s status and consult with an EB-5 immigration attorney or EB-5 Visa Consultant to ensure your project meets the TEA qualifications.

Book Your Free Consultation with Paperfree EB-5 Visa Experts. Get Personalized Advice and Investment Plans. Book Your Free Consultation Today!

Take Away

The EB-5 visa is a complex process, and beyond the required investment amount, there are additional costs such as consultant charges, attorney fees, regional center administration fees, and other miscellaneous expenses. It is advisable to consult an EB-5 visa consultant or an EB-5 attorney to stay updated with accurate information and ensure a smooth visa process.

Pages Related to #eb 5 investment amount

- EB 5 investment projects list USA

- EB5 Investment Projects | Here's All You Need To Know

- EB5 Investment Visa Guide 2025

- Paperfree Investment Visa EB-5 Program is Your Your Clear Path to Green Card USA

- US Immigration: Big increase in EB–5 visa fees proposed

- EB-5 for Tech Entrepreneurs: Immigration Program for Startup Founders | Paperfree

- EB-5 Regional Center Program 2027 Expiration: Secure Your Green Card Before Deadline | Renewal Updates

- EB 5 visa problems: Potential Pitfalls and Challenges in Obtaining Eb-5 Visa

Popular Page

Benefits of the EB-5 Visa Program| A Comprehensive Guide

Book a Free Complimentary Call

real estate investing Investment Visa USA Investment Magazine Private Real Estate Funds real estate funds