Real Estate Investing

FREE CONSULTATION

Real Estate Investment Strategies Guide by PaperFree

The Complete 2025 Guide for Building Wealth Through Propertylast updated Monday, August 11, 2025

#real estate investment strategies #real estate investment strategy

| | by John Burson |

QUICK LINKS

Real estate investment strategies remain the backbone of wealth creation for millions of investors worldwide. Whether you're taking your first steps into property investment or you're a seasoned investor looking to diversify your portfolio, understanding the full spectrum of real estate investment opportunities is crucial for long-term financial success.

This comprehensive guide reveals proven real estate investment strategies that have helped investors generate consistent returns, build passive income streams, and create generational wealth. From beginner-friendly approaches requiring minimal capital to sophisticated institutional strategies, you'll discover actionable insights backed by current market data and real-world case studies.

Why Real Estate Investment Strategies Matter More Than Ever in 2025

The current economic landscape presents unique opportunities for savvy real estate investors. With concerns about inflation, demographic shifts, and evolving work patterns reshaping the housing market, strategic property investment has become more critical than ever.

The Numbers Tell the Story:

Real estate has consistently outperformed many traditional investments over the long term. According to the National Association of Realtors, residential properties have appreciated at an average rate of 6.5% annually over the past 50 years, significantly outpacing inflation rates of 3.8% during the same period.

Current Market Dynamics Creating Opportunities:

The 2025 real estate market is characterized by several key trends that savvy investors are leveraging:

- Interest Rate Stabilization: After the volatility of 2022-2024, rates are stabilizing around 6-7%, creating predictable financing conditions

- Remote Work Revolution: Permanent shifts in work patterns are driving demand in secondary and tertiary markets

- Millennial Homebuying Peak: The largest generation in history is entering their prime homebuying years

- Infrastructure Investment: Federal infrastructure spending is boosting property values in targeted regions

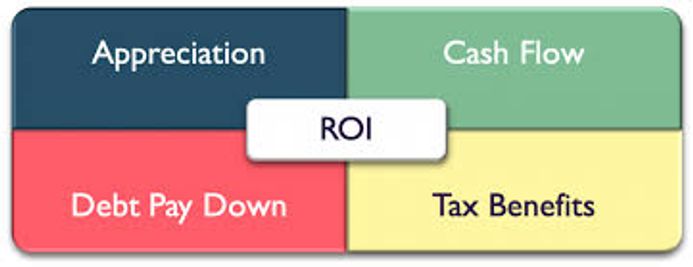

The Four Pillars of Real Estate Returns

Successful real estate investment strategies generate wealth through four distinct mechanisms:

- Cash Flow: Monthly rental income that exceeds expenses

- Appreciation: Long-term increase in property values

- Tax Advantages: Depreciation, deductions, and tax-deferred exchanges

- Leverage Benefits: Using borrowed money to amplify returns

Understanding how each strategy leverages these pillars is crucial for selecting the right approach to achieve your financial goals and manage your risk tolerance.

Beginner Real Estate Investment Strategies: Your Foundation for Success

Starting your real estate investment journey doesn't require massive capital or extensive experience. These foundational strategies help new investors build knowledge, generate returns, and accumulate capital for more advanced approaches.

1. Buy-and-Hold Rental Properties: The Time-Tested Wealth Builder

The buy-and-hold strategy remains the most reliable path to real estate wealth. This approach involves purchasing properties with strong rental potential and holding them for extended periods to benefit from both cash flow and appreciation.

Why Buy-and-Hold Works:

Buy-and-hold properties generate returns through multiple channels simultaneously. While tenants pay down your mortgage principal, property values typically appreciate over time, and rental income provides ongoing cash flow. Meanwhile, depreciation deductions reduce your tax burden, creating additional Value.

Key Success Metrics for Buy-and-Hold Properties:

| Metric | Target Range | Why It Matters |

|---|---|---|

| Cap Rate | 6-10% | Measures a property's income potential |

| Cash-on-Cash Return | 8-15% | Shows return on invested capital |

| Debt Service Coverage | 1.25x+ | Ensures rent covers mortgage payments |

| Vacancy Rate (Market) | <8% | Indicates rental demand stability |

Real-World Success Story: The Austin Rental Property

Sarah Martinez, a software engineer from Dallas, exemplifies the successful practice of buy-and-hold investing. In 2021, she purchased a $295,000 single-family home in a growing Austin suburb with these results:

- Initial Investment: $73,750 (25% down payment)

- Monthly Rent: $2,350

- Monthly Expenses: $1,925 (including mortgage, taxes, insurance, maintenance)

- Net Cash Flow: $425 monthly ($5,100 annually)

- Cash-on-Cash Return: 6.9%

Three Years Later (2024):

- Property Value: $347,000 (17.6% appreciation)

- Total Rental Income: $84,600

- Mortgage Principal Paydown: $22,100

- Total Return on Investment: 71.8%

This example demonstrates how buy-and-hold strategies create wealth through multiple income streams while requiring minimal ongoing management.

2. House Hacking: Live for Free While Building Wealth

House hacking represents one of the most potent strategies for new investors with limited capital. By purchasing a multi-unit property, living in one unit, and renting the others, investors can eliminate housing costs while building equity and investment experience.

The House Hacking Advantage:

This strategy provides access to owner-occupied financing, which typically offers lower down payments (3-5%) and better interest rates compared to traditional investment property loans. Additionally, investors gain hands-on property management experience while their tenants help pay the mortgage.

Popular House Hacking Structures:

Duplex House Hacking remains the most popular approach, offering the perfect balance of management simplicity and income potential. With two units, investors can typically cover their entire mortgage payment with rental income from one unit while living mortgage-free in the other.

Fourplex Strategies provide maximum income potential while still qualifying for residential financing. Many successful investors begin with fourplexes, as they can generate substantial cash flow while providing valuable experience in managing multiple units.

ADU (Accessory Dwelling Unit) Conversion involves adding a separate living space to a single-family home, creating rental income opportunities in markets where multi-unit properties are scarce or expensive.

3. Real Estate Investment Trusts (REITs): Professional Management, Passive Income

For investors seeking real estate exposure without direct property ownership responsibilities, REITs offer an accessible entry point with professional management and instant diversification.

Understanding REIT Performance by Sector (2020-2024):

Different REIT sectors have performed distinctly over recent years, with some significantly outpacing others:

- Industrial REITs have been the standout performers, driven by e-commerce growth and the reshoring of supply chains. These properties, including warehouses and distribution centers, have generated average annual returns of 12.8% while maintaining relatively low volatility.

- Residential REITs have delivered strong performance, with an average annual return of 8.2% and a dividend yield of approximately 3.4%. REITs benefit from stable housing demand and predictable rental income streams.

- Office REITs have faced challenges from remote work trends, posting modest average returns of 4.1%. However, this sector may present opportunities for contrarian investors as markets stabilize and companies define long-term office needs.

- Healthcare REITs have demonstrated resilience with an average return of 7.6%, supported by aging demographics and the essential nature of medical facilities as a service.

4. Real Estate Crowdfunding: Institutional-Quality Deals with Retail Investment Minimums

Modern technology has democratized access to commercial real estate through crowdfunding platforms, allowing smaller investors to participate in larger, professionally managed deals.

Leading Platforms and Their Specialties:

- Fundrise focuses on diversified portfolios with low $500 minimums, making it ideal for beginning investors seeking broad real estate exposure without property management responsibilities.

- YieldStreet targets accredited investors with a minimum investment of $10,000, offering access to alternative investments, including real estate debt, development projects, and specialized property types.

- RealtyMogul focuses on commercial properties with a minimum investment of $5,000, offering detailed investment analysis and direct communication with sponsors.

- CrowdStreet caters to sophisticated investors with a minimum investment of $25,000, featuring institutional-quality commercial deals that include detailed financial projections and market analysis.

Intermediate Real Estate Investment Strategies: Scaling Your Portfolio

As investors gain experience and capital, intermediate strategies offer higher return potential while requiring more active involvement and market knowledge.

1. Fix-and-Flip Properties: Profit Through Value Creation

Fix-and-flip strategies generate returns by purchasing undervalued properties, improving them through renovations, and reselling at market value. This approach creates wealth through forced appreciation rather than long-term holding.

Current Fix-and-Flip Market Analysis:

The fix-and-flip market has undergone significant evolution in recent years. According to ATTOM Data Solutions Q3 2024 report, fix-and-flip investors achieved:

- Average Gross Profit: $68,200 per property

- Average Investment: $247,500 (purchase price plus renovation costs)

- Average Gross ROI: 27.6%

- Average Project Timeline: 5.4 months

Critical Success Factors for Fix-and-Flip Projects:

- Accurate After Repair Value (ARV) Assessment is crucial for project success. Experienced flippers utilize comparative market analysis, recent sales data, and local market knowledge to estimate post-renovation values with an accuracy of 3-5%.

- Reliable Contractor Networks can make or break flip projects. Successful investors cultivate relationships with licensed, insured contractors who deliver quality work on schedule and within budget.

- Efficient Project Management involves coordinating multiple trades, managing timelines, and maintaining quality control throughout the renovation process.

- Adequate Capital Reserves protect against cost overruns and unexpected issues. Experienced flippers typically budget 20-30% of the purchase price as contingency funds for unforeseen expenses.

2. The BRRRR Method: Infinite Returns Through Capital Recycling

BRRRR (Buy, Rehab, Rent, Refinance, Repeat) combines fix-and-flip renovation strategies with buy-and-hold rental income, allowing investors to recycle capital while efficiently building rental portfolios.

The BRRRR Process Explained:

This strategy begins with purchasing undervalued properties, typically those needing moderate to significant renovation. After completing the improvements, investors rent the properties at market rates and then refinance based on the improved Value, extracting most or all of their invested capital.

BRRRR Success Case Study: The Phoenix Transformation

Michael Chen, a real estate investor from Phoenix, demonstrates successful BRRRR implementation:

Property Acquisition:

- Purchase Price: $162,000

- Renovation Investment: $38,000

- Total Project Cost: $200,000

Post-Renovation Results:

- Appraised Value: $260,000

- Monthly Rent: $2,100

- Annual Rental Income: $25,200

Refinancing Outcome:

- New Loan Amount: $208,000 (80% LTV)

- Cash Recovered: $8,000 (exceeded initial investment)

- Remaining Investment: $0 (infinite return scenario)

- Annual Cash Flow: $7,200 (after debt service and expenses)

This example illustrates how BRRRR strategies can generate infinite returns when executed successfully, enabling investors to build portfolios without continually adding capital.

3. Short-Term Rental Properties: Premium Returns Through Active Management

The growth of platforms like Airbnb and VRBO has created opportunities for significantly higher rental yields through short-term accommodations, particularly in tourist destinations and business centers.

Short-Term Rental Market Performance (2024):

Short-term rentals have demonstrated strong performance across various market types, though success requires more active management than traditional rentals:

- Beach and Resort Markets command premium daily rates averaging $267, with seasonal occupancy rates reaching 72% during peak periods. Annual revenues typically range from $55,000 to $75,000 for well-positioned properties.

- Mountain and Ski Destinations achieve even higher daily rates, averaging $341, though occupancy rates are more seasonal, at 58% annually. Properties in prime locations can generate $65,000 to $85,000 annually.

- Urban Business Centers offer steady demand, with an average daily rate of $178 and a 78% occupancy rate. While individual rates are lower, consistent demand creates reliable income streams averaging $ 50,000 to $65,000 annually.

Regulatory Considerations:

Short-term rental regulations vary significantly by location and are constantly evolving. Successful investors thoroughly research local regulations, obtain the necessary permits, and stay informed about regulatory changes that could impact their operations.

4. Commercial Real Estate Investment: Institutional-Grade Returns

Commercial properties offer higher income potential and longer lease terms but require larger capital commitments and specialized knowledge of commercial markets and financing.

Commercial Property Types and Investment Characteristics:

- Office Buildings have faced challenges from remote work trends, but they may also present opportunities for patient investors. Properties with modern amenities, flexible layouts, and strong transportation access continue to attract tenants willing to pay premium rents.

- Retail Properties require careful tenant analysis and a thorough understanding of the market. Grocery-anchored centers and essential service retail have shown resilience, while traditional mall formats continue struggling.

- Industrial and Warehouse Properties have benefited tremendously from e-commerce growth and supply chain reshoring. These properties typically offer stable, long-term leases with built-in rent escalations.

- Multi-Family Properties (5+ Units) provide diversified income streams and economies of scale in management and maintenance. Professional property management becomes essential at this scale.

Advanced Real Estate Investment Strategies: Institutional-Grade Wealth Building

High-net-worth investors and sophisticated practitioners employ advanced strategies that require significant capital, expertise, and risk tolerance, offering the potential for exceptional returns.

1. Real Estate Syndications: Passive Investment in Large Commercial Deals

Syndications enable multiple investors to pool their resources for larger commercial acquisitions, combining professional management with the passive investment characteristics.

Understanding Syndication Structure:

Real estate syndications typically involve General Partners (GPs) who identify, acquire, and manage properties, while Limited Partners (LPs) provide capital in exchange for ownership stakes and share in the profits.

Typical Return Structure:

- Preferred Return: 7-9% annual return to LPs before GP participation

- Profit Split: 70/30 (LP/GP) until 15% IRR threshold, then 50/50

- Hold Period: 3-7 years, depending on business plan

- Minimum Investment: $50,000-$100,000 for most deals

Syndication Investment Example:

A 200-unit apartment complex syndication in Austin, Texas:

- Total Project Cost: $45 million

- Investor Equity: $13.5 million (30%)

- Business Plan: Value-add renovation over 2 years

- Projected Returns: 8% preferred return, 18% IRR, 2.1x equity multiple

This structure enables individual investors to participate in institutional-quality deals, benefiting from professional management and economies of scale.

2. Opportunity Zone Investing: Tax-Advantaged Development

The Opportunity Zone program provides substantial tax incentives for long-term investments in designated low-income communities, making it particularly attractive for investors with significant capital gains.

Opportunity Zone Tax Benefits Timeline:

- Years 1-5: Capital gains taxes deferred on original Investment.

- Year 5: 10% reduction in original deferred capital gains.

- Year 7: An Additional 5% reduction (15% total) in the original deferred gains.

- Year 10+: Complete elimination of taxes on new Opportunity Zone investment gains.

Qualified Opportunity Zone Investment Process:

Investors must invest capital gains into Qualified Opportunity Funds (QOFs) within 180 days of realizing gains. These funds must deploy capital into Opportunity Zone properties or businesses within specific timeframes and hold investments for at least 10 years to maximize tax benefits.

OZ Development Case Study: Miami Opportunity Zone Project

A mixed-use development in Miami's Opportunity Zone demonstrates the program's potential:

Project Details:

- Location: Overtown Opportunity Zone

- Investment: $25 million QOF investment

- Development: 150-unit mixed-income residential with ground-floor retail

- Timeline: 3-year development, 7+ year hold period

Projected Outcomes:

- Original Capital Gains Deferral: $8 million (deferred until 2026)

- Tax Reduction on Deferred Gains: $1.2 million (15% reduction)

- New Investment Appreciation: $15 million (tax-free after 10 years)

- Total Tax Savings: $4.8 million over investment period

3. Real Estate Private Equity: Institutional Investment Strategies

Private equity real estate strategies focus on value creation through operational improvements, strategic repositioning, and optimal market timing.

Private Equity Investment Strategy Classifications:

- Core Strategies focus on high-quality, stabilized properties in major markets with predictable cash flows and modest appreciation potential. These investments typically target annual returns of 6-9% with minimal risk.

- Core-Plus Investments involve high-quality properties requiring minor improvements or re-leasing to achieve stabilized performance. Expected returns range from 8% to 12% annually, with moderate risk profiles.

- Value-Add Projects require significant capital improvements, leasing efforts, or operational changes to achieve projected returns of 12-18% annually. These investments carry higher risk but offer greater potential for upside.

- Opportunistic Strategies involve the highest risk and return potential, including ground-up development, major repositioning, or distressed acquisitions. Target returns typically exceed 18-25% annually.

4. Ground-Up Development: Maximum Returns, Maximum Risk

Development projects offer the highest return potential in real estate but require extensive expertise in construction, entitlements, market analysis, and project management.

Development Project Risk and Timeline Analysis:

- Pre-Development Phase (6-18 months)

Land acquisition, entitlements, and design development carry moderate to high risk, with potential project termination if approvals aren't obtained. - Construction Phase (12-24 months)

Active construction presents a high risk of cost overruns, delays, and quality issues; however, these risks are more manageable with experienced teams. - Lease-Up/Sale Phase (6-18 months)

Market risk becomes the primary concern as projects must achieve projected rents or sale prices to meet return targets.

Development Success Metrics:

- Development Yield: 15-25% return on total project cost

- Profit Margin: 20-35% of total development cost

- Risk-Adjusted IRR: 20-35% annually, accounting for development timeline

Risk Management and Portfolio Construction: Protecting Your Wealth

Successful real estate investment strategies require disciplined risk management and thoughtful portfolio construction to maximize returns while minimizing downside exposure.

Geographic Diversification: Spreading Market Risk

Concentrating investments in single markets exposes portfolios to local economic downturns, regulatory changes, and natural disasters. Savvy investors diversify across multiple markets with different economic drivers.

Recommended Market Allocation Strategy:

- Primary Markets (40-50% allocation): Major metropolitan areas, such as New York, Los Angeles, San Francisco, and Washington, D.C., offer stability, liquidity, and institutional-quality properties, albeit at lower yields.

- Secondary Markets (30-40% allocation): Growing cities such as Austin, Nashville, Denver, and Raleigh offer a balance between stability and growth potential, with moderate yields.

- Tertiary Markets (10-20% allocation): Smaller markets, such as Boise, Des Moines, and Spokane, offer higher yields but require careful analysis of local economic drivers and exit liquidity.

Property Type Diversification: Balancing Income and Growth

Different property types respond differently to economic cycles, providing portfolio stability through diversification across asset classes.

- Residential Properties offer stable demand driven by housing needs, but face challenges from interest rate changes and affordability issues.

- Office Buildings provide long-term leases and professional tenants but face structural challenges from remote work trends.

- Industrial Properties benefit from e-commerce growth and supply chain trends, offering stable returns with growth potential.

- Retail Properties require careful tenant analysis but can provide steady returns in well-located, necessity-based centers.

Leverage Management: Maximizing Returns While Controlling Risk

While leverage amplifies returns, it also increases risk. Prudent investors maintain conservative debt-to-equity ratios and stress-test portfolios under adverse scenarios.

Conservative Leverage Guidelines:

- Buy-and-Hold Rentals

A maximum loan-to-value ratio of 75-80% with a 1.25x debt service coverage ratio ensures properties can withstand vacancy periods and rent declines. - Value-Add Projects

Maximum 70-75% LTV with 1.30x coverage ratio accounts for renovation risks and temporary income disruption. - Development Projects

Maximum 65-70% LTV with 1.40x coverage ratio provides a buffer for construction delays and cost overruns. - Interest Rate Risk Management

Investors should stress-test their portfolios, assuming 200-300 basis points of interest rate increases, to ensure continued viability.

Tax Optimization Strategies: Keeping More of What You Earn

Real estate offers numerous tax advantages that can significantly enhance after-tax returns when properly utilized.

Depreciation and Cost Segregation: Accelerating Tax Benefits

Depreciation allows investors to deduct the cost over time, creating tax-free cash flow from rental income.

Standard Depreciation spreads building costs over 27.5 years for residential properties and 39 years for commercial properties, providing consistent annual deductions. Cost Segregation Studies identify property components that can be depreciated faster, accelerating tax benefits and improving cash flow.

Cost Segregation ImpDepreciation:

A $750,000 rental property using cost segregation versus standard Depreciation:

Standard Method: $27,273 annual depreciation. Cost Segregation Method: $89,500 first-year depreciation. Additional Tax Savings: $19,953 (32% tax bracket).. Study Cost: $12,500. Net First-Year Benefit: $7,453

1031 Like-Kind Exchanges: Deferring Capital Gains

Section 1031 exchanges enable investors to defer capital gains taxes by reinvesting proceeds in similar properties, allowing for portfolio growth without tax erosion.

Exchange Timeline Requirements:

- 45-Day Identification Period

Investors must identify up to three potential replacement properties within 45 days of selling their relinquished property. - 180-Day Exchange Period

Investors must complete the acquisition of replacement property within 180 days of the original sale. - Equal or Greater Value

Replacement properties must be of equal or greater Value, and all proceeds must be reinvested to avoid taxable events.

Strategic Exchange Planning:

Successful 1031 exchanges require careful planning, the selection of a qualified intermediary, and the identification of backup properties to ensure compliance with the strict IRS timelines.

Real Estate Professional Status: Unlocking Passive Loss Deductions

Investors qualifying as real estate professionals can deduct rental losses against other income, providing significant tax advantages for active investors.

Qualification Requirements:

- More than 50% of personal services are performed in real estate activities

- Minimum 750 hours annually in real estate activities

- Material participation in rental activities

Tax Benefits: Real estate professionals can deduct unlimited rental losses against ordinary income, potentially saving thousands in annual taxes.

Market Analysis and Timing: Optimizing Entry and Exit Strategies

Understanding market cycles and economic indicators enables investors to optimize their timing for acquisitions, dispositions, and strategic adjustments.

Real Estate Market Cycles: Timing Your Investments

Real estate markets follow predictable cycles that savvy investors utilize to their advantage, enabling them to select optimal timing and strategies.

- Recovery Phase (1-3 years)

Characterized by rising interest rates, phasing out building permits, and limited new construction. This Phase provides opportunities to acquire distressed assets at attractive prices before the market recovers. - Expansion Phase (3-5 years)

Features include rising rents, increased construction activity, and strong investor demand. Value-add strategies perform well as rent growth drives property appreciation. - Hyper-Supply Phase (1-2 years)

Marked by peak rents, oversupply concerns, and aggressive competition. Savvy investors consider the disposition of appreciated assets and prepare for potential downturns. - Recession Phase (1-3 years)

Characterized by falling occupancy, declining rents, and distressed sales. Cash-rich investors find exceptional opportunities for long-term wealth building.

Key Economic Indicators for Real Estate Investment

Monitoring leading economic indicators enables investors to anticipate market changes and adjust their strategies accordingly.

- Employment Growth drives housing demand with a 6-12 month lead time, making job market analysis crucial for investment timing.

- Interest Rate Trends affect property affordability and cap rates with 3-6 month impact timelines, requiring active monitoring for refinancing and acquisition decisions.

- Population Growth indicates long-term demand trends with 12-24 month predictive Value, essential for market selection and long-term strategy planning.

- Construction Permit Activity reveals a supply pipeline with 12-18 months lead time, helping investors anticipate competition and market balance changes.

Financing and Leverage Strategies: Optimizing Capital Structure

Access to favorable financing is crucial for scaling real estate investment strategies and maximizing returns on invested capital.

Traditional Financing: Building Banking Relationships

- Conventional Investment Property Mortgages typically require 20-25% down payments with interest rates 0.5-1.0% above owner-occupied rates. Building relationships with portfolio lenders can improve terms and streamline future acquisitions.

- Commercial Real Estate Loans offer higher leverage for larger properties but require personal guarantees and more extensive financial documentation. Terms typically include 5-10 year fixed periods with 20-30 year amortization schedules.

- Portfolio Lending through community banks and credit unions often provides more flexible underwriting and faster closing times for experienced investors with proven track records.

Alternative Financing: Creative Capital Solutions

Private Money Lending offers speed and flexibility for time-sensitive opportunities, though at higher interest rates (8-15% annually) and shorter terms (6 months to 3 years).

Hard Money Loans provide rapid funding for fix-and-flip projects, typically closing within 3-7 days at rates of 10-18% annually plus 2-5 origination points.

Seller Financing can create win-win scenarios with below-market rates, flexible terms, and reduced closing costs, beautiful in slower markets or for retiring property owners.

Creative Financing Techniques: Advanced Capital Strategies

- Subject-to acquisitions involve taking over existing mortgage payments without a formal loan assumption, offering access to properties with minimal cash investment, though they carry legal and ethical considerations.

- Master Lease Agreements provide control and income potential without ownership, allowing investors to profit from property improvements and management while preserving capital for other opportunities.

- Joint Venture Partnerships combine investor capital with operator expertise, sharing risks and returns while leveraging complementary strengths.

Frequently Asked Questions About Real Estate Investment Strategies

What are the best real estate investment strategies for beginners starting with limited capital?

The most effective real estate investment strategies for beginners include house hacking, which allows you to live in one unit of a multi-family property while renting others to cover mortgage payments. With just a 3-5% down payment, new investors can eliminate housing costs while building investment experience.

REITs offer another excellent starting point, providing real estate exposure with as little as $100. These professionally managed trusts offer diversification across various property types and geographic regions, eliminating the need for direct management responsibilities.

Real estate crowdfunding platforms, such as Fundrise, enable participation in commercial deals with a minimum investment of $500, giving beginners access to institutional-quality properties with professional management.

For those with slightly more capital ($50,000-$100,000), single-family buy-and-hold rentals in growing markets provide steady cash flow and appreciation potential while building fundamental investment skills.

How much money do I realistically need to start investing in real estate in 2025?

Capital requirements vary significantly by strategy and market conditions:

Minimum Investment Options:

- REITs and real estate ETFs: $100-$1,000

- Crowdfunding platforms: $500-$25,000

- House hacking: $15,000-$40,000 (3-5% down payment plus reserves)

- Single-family rentals: $60,000-$150,000 (20-25% down payment plus reserves)

Important Capital Considerations: Beyond down payments, successful investors maintain 6-12 months of property expenses in reserves for vacancies, repairs, and opportunities. This typically adds $15,000 to $30,000 per property to your capital requirements.

Many successful investors start with house hacking or REITs while saving for traditional rental properties, gradually building capital and experience for larger investments.

Which real estate investment strategies offer the highest returns in today's market?

Return potential varies significantly by strategy, risk level, and execution quality:

Highest Return Potential (with corresponding high risk):

- Ground-up development: 20-35% IRR potential

- Fix-and-flip in strong markets: 25-40% annual returns

- Value-add commercial projects: 15-25% IRR

Best Risk-Adjusted Returns:

- Buy-and-hold in growth markets: 8-15% total annual returns

- BRRRR method executed properly: 12-20+ cash-on-cash returns

- Commercial triple-net lease properties: 6-10% stable returns

Current Market Favorites: Industrial properties and self-storage facilities are performing exceptionally well, driven by e-commerce growth and changing consumer behavior. Affordable housing in secondary markets also offers strong fundamentals, with lower competition compared to the luxury segments.

Remember that the "highest returning" strategy is one you can execute successfully while managing downside risk appropriately.

How do real estate investment strategies perform during economic recessions?

Real estate performance during downturns varies significantly by property type, location, and debt levels:

Recession-Resistant Strategies:

- Essential services properties (grocery-anchored retail, medical facilities)

- Affordable workforce housing in diverse job markets

- Self-storage and mobile home parks

- Government-leased properties with long-term contracts

Vulnerable Strategies:

- Luxury housing and high-end retail

- Hospitality and entertainment properties

- Office buildings in secondary markets

- High-leverage development projects

Historical Context (2008-2009 Recession):

- Well-located rental properties maintained positive cash flows

- Residential prices declined 20-50% in overheated markets

- Commercial properties fell 35-40% but recovered within 4-5 years

- REITs declined 60-70% but provided exceptional buying opportunities

Recession Preparation Strategies: Maintain low leverage (under 70% LTV), focus on essential-use properties, build cash reserves, and prepare for opportunities during distressed periods.

What are the most important tax advantages of real estate investing?

Real estate offers numerous tax benefits that can significantly enhance after-tax returns:

Universal Tax Benefits:

- Depreciation deductions (1.8-3.6% of property value annually).

- Mortgage interest deductions on investment properties.

- Operating expense deductions (repairs, management, insurance).

- 1031 exchanges for capital gain, Depreciation,

Advanced Tax Strategies:

- Cost segregation studies can accelerate Depreciation, creating larger upfront deductions.

- Opportunity Zone investments can eliminate capital gains taxes after a 10-year hold.

- Real Estate Professional Status allows unlimited passive loss deductions against ordinary income.

Strategy-Specific Advantages: Buy-and-hold properties benefit from long-term capital gains treatment and depreciation recapture at favorable 25% rates. Fix-and-flip investors can deduct business expenses and potentially qualify for dealer status benefits.

REITs offer qualified dividend treatment with a current 20% deduction under Section 199A.

Tax Planning Importance: Collaborate with qualified tax professionals to optimize your specific situation, as tax laws are subject to frequent changes, and individual circumstances vary significantly. Proper tax planning can add 2-4% annually to after-tax returns through legitimate deduction and deferral strategies.

Sources and References

Market Data and Research Sources

- National Association of Realtors Market Statistics

- Federal Reserve Economic Data (FRED)

- U.S. Census Bureau Housing Statistics

- Commercial Real Estate Direct Research

- ATTOM Data Solutions Market Reports

Investment Strategy and Education Resources

Free Consultation

Similar Pages

- Real Estate Investing for Beginners by Paperfree Real Estate Investor Magazine

- Browse Real Estate Investment Strategies

- Invest in Value Add Real Estate Strategy to balance capital growth with income generation.

- Invest in Core Real Estate Strategy to maximize income with minimal risk.

- Invest in Opportunistic Real Estate Strategy to maximize the potential for capital growth.

Popular

Vetted Private Real Estate Funds Investments to Drive Income and Capital Growth

Search within Paperfree.com