Real Estate Investing

FREE CONSULTATION

REIT Valuation by FFO and AFFO

Real estate is different from equipment assets. This is because the property loses value gradually occasionally and often appreciates. You can't always rely on net income, so it's good to judge REITs by FFO.last updated Monday, May 12, 2025

#reit valuation #AFFO

| | by John Burson |

QUICK LINKS

AD

Get access to EB 5 Visa Investment Projects

Understanding AFFO in Real Estate Investment Trusts (REITs) in 2025

Investors evaluating Real Estate Investment Trusts (REITs) continue to find that traditional financial metrics like Earnings Per Share (EPS) and Price-to-Earnings (P/E) ratios are not only inapplicable but also unreliable for assessing REIT performance. As the real estate market evolves, especially with emerging trends in sustainability and technology integration, metrics tailored to the unique aspects of real estate—such as Funds From Operations (FFO) and Adjusted Funds From Operations (AFFO)—remain essential for a precise evaluation of a REIT's value and operational health.

Why Traditional Metrics Fall Short for REITs

Traditional financial metrics are designed for general corporate evaluations and do not account for the specific financial dynamics inherent to REITs. Here's why EPS and P/E ratios miss the mark:

-

Depreciation and Amortization: These non-cash charges reflect the cost of property investment but do not accurately represent the real estate asset's performance. Unlike fixed-plant or equipment assets, real estate properties can appreciate over time or lose value gradually, making net income an unreliable sole indicator.

-

Net Income Limitations: Relying solely on net income can be misleading for REITs as it doesn't fully capture the cash flow available to shareholders after accounting for necessary adjustments like depreciation and property sales gains.

Funds From Operations (FFO)

FFO remains the cornerstone metric for evaluating REITs, as it adjusts net income for depreciation, amortization, and gains on property sales, offering a clearer picture of the cash flow generated by a REIT's operations.

FFO Calculation

- Start with Net Income

- Add Depreciation and Amortization

- Subtract Gains on Sales of Property

Formula:

Adjusted Funds From Operations (AFFO)

AFFO builds upon FFO by accounting for capital expenditures necessary to maintain the REIT’s properties. This adjustment makes AFFO a more refined measure of the residual cash flow available to shareholders, enhancing the accuracy of valuation estimates and providing better insights into a REIT's ability to sustain and grow dividends.

Why Use AFFO?

- Residual Cash Flow: AFFO offers a more detailed measure of the cash flow available to shareholders after covering essential expenses, making it a superior indicator of financial health.

- Dividend Sustainability: AFFO better predicts a REIT’s capacity to maintain and increase dividend payments, which is crucial for income-focused investors.

AFFO Calculation

- Calculate FFO: Use the FFO formula as outlined above.

- Normalize FFO:

- Add Non-Recurring Items

- Subtract Capital Expenditures (CAPEX): Only maintenance CAPEX should be deducted, not growth CAPEX.

Formula:

Recent Developments in FFO and AFFO Metrics (2023-2025)

As of early 2025, the following trends and developments have influenced the use and calculation of FFO and AFFO in the REIT sector:

- Sustainability Adjustments

With increasing emphasis on environmental, social, and governance (ESG) criteria, some REITs are adjusting AFFO calculations to account for sustainability-related capital expenditures. This ensures that investments in green building technologies and certifications are accurately reflected in cash flow assessments. - Technology Integration

The rise of PropTech has led to increased capital expenditures in technology infrastructure for property management and tenant services. AFFO calculations now often distinguish between traditional maintenance CAPEX and technology-driven upgrades to provide a clearer picture of cash flow availability. - Regulatory Changes

New accounting standards introduced in 2024 require more granular reporting of non-recurring items and capital expenditures. These changes enhance the transparency and comparability of AFFO across different REITs. - Market Volatility and Inflation

The real estate market has experienced increased volatility and inflationary pressures, impacting maintenance CAPEX and, consequently, AFFO. Investors are now placing greater emphasis on AFFO trends over multiple quarters to gauge the resilience of REITs amidst economic fluctuations.

What Constitutes a Good FFO for a REIT?

As of 2025, the standard FFO margin for REITs remains robustly between 70-80%. However, with the evolving market conditions and increased capital expenditure requirements, the benchmarks have slightly adjusted:

- 70-85%: A healthy FFO margin indicating strong operational performance and efficient management.

- 85-100%: Indicates that the REIT may be approaching the threshold where dividend cuts could be imminent, as a higher percentage of FFO is being allocated to cover expenses and capital needs.

Reit valuation model Excel.

Growth in FFO and AFFO

The REIT's value can be more accurately estimated when the FFO and AFFO seek expected growth using one or more metrics. Investors need to observe the prospects of the REIT very carefully. A few things to consider before evaluating the growth of REIT:

- The probability of an increase in rent

- The possibility of improving occupancy rates

- Upgrading properties to attract tenants

- External growth prospects

REIT evaluation provides clarity when dealing with FFO rather than net income. Prospective investors should also calculate AFFO, which cuts expenses to maintain a stable real estate portfolio. AFFO also provides excellent tools for gauging the REIT's dividend and growth.

Applying a Multiple to FFO/AFFO

The total REIT's return is dividends paid plus price appreciation.

Total Return (REIT) = Dividents + Price Appreciation

Next, price appreciation can be broken into two components: growth in FFO/AFFO and expansion in the price-to-FFO or price-to-AFFO multiple.

Price Appriciation = Growth in FFO/AFFO + price-to-FFO

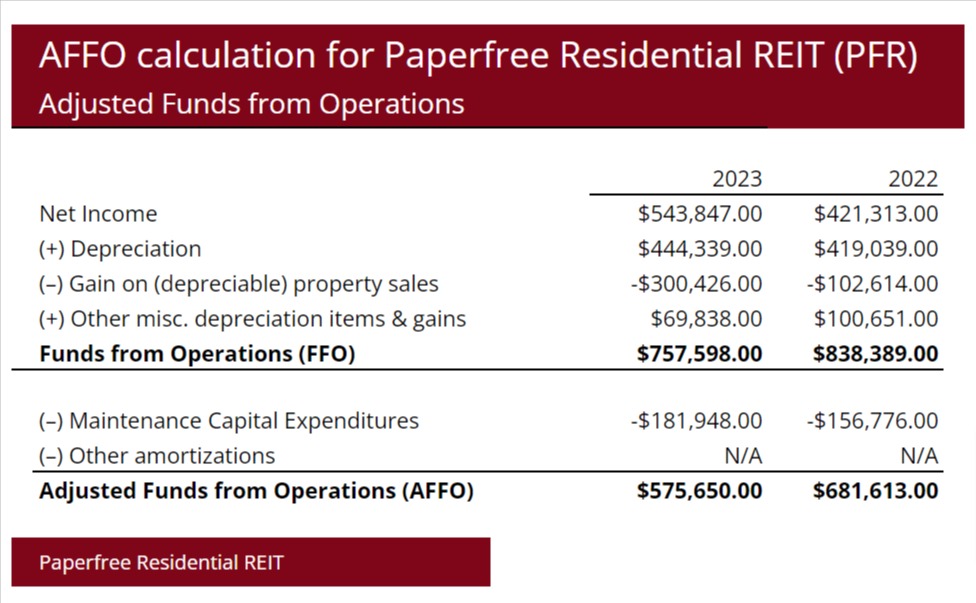

Let's look at multiples for Paperfree Residential. Note that we are showing price/market capitalization divided by FFO. Paperfree Residencial's market cap* in this example is $8M.

*where market cap is the number of shares multiplied by the price per share.

.jpg)

Frequently Asked Questions (FAQ)

1. What is the AFFO Formula According to CFA Standards?

The Adjusted Funds From Operations (AFFO) formula, as defined by the Chartered Financial Analyst (CFA) Institute, is:

Where:

- FFO (Funds From Operations):

- CAPEX (Capital Expenditures): Refers to recurring capital expenditures necessary for maintaining the REIT’s properties.

- AFFO (Adjusted Funds From Operations): Represents the cash flow available to shareholders after accounting for maintenance CAPEX.

2. What is the Difference Between AFFO and FFO?

The main distinction between AFFO (Adjusted Funds From Operations) and FFO (Funds From Operations) lies in the treatment of capital expenditures:

-

FFO: Measures the cash generated by a REIT's operations by adding back non-cash charges like depreciation and subtracting gains or losses from property sales.

-

AFFO: Enhances FFO by subtracting recurring capital expenditures (CAPEX) necessary to maintain the properties, providing a more accurate picture of the cash flow available to shareholders.

In summary:

3. Why is AFFO Preferred Over FFO for Valuing REITs?

Adjusted Funds From Operations (AFFO) is preferred over Funds From Operations (FFO) because it accounts for recurring capital expenditures (CAPEX), providing a more accurate measure of the cash flow available to shareholders. This inclusion of CAPEX enhances the assessment of dividend sustainability and improves valuation accuracy, making AFFO a superior metric for evaluating the financial health and investment potential of REITs.

4. How is AFFO Used in Valuing REITs?

Adjusted Funds From Operations (AFFO) is essential in valuing REITs as it provides a clear view of the cash flow available to investors. AFFO is utilized in dividend discount models (DDM) to estimate the present value of future dividends, enables comparative analysis by normalizing variations in capital expenditures across different REITs, and facilitates performance tracking by assessing the consistency and growth of a REIT’s cash flows. This comprehensive approach aids investors in evaluating management effectiveness and the overall operational stability of REITs.

5. What Are the Limitations of Using AFFO?

While Adjusted Funds From Operations (AFFO) is a valuable metric for assessing REIT performance, it has several limitations. Subjectivity in CAPEX Classification can lead to inconsistencies, as determining which capital expenditures qualify as maintenance versus growth CAPEX may vary between REITs. Non-Standardized Calculations mean that AFFO lacks a universally accepted formula, causing discrepancies across different analysts and REITs. Additionally, Exclusion of Growth Investments means AFFO does not account for capital needed for expansion and long-term growth, potentially underrepresenting a REIT’s investment needs. Lastly, Reliance on Historical Data can be a drawback, as past financial performance may not accurately predict future results, especially in volatile or rapidly changing real estate markets.

Free Consultation

Similar Pages

- Real Estate Investing Basics: 2 Ways of Real Estate Investment

- Are REITs safe investment? REIT risks explained. Mortgage REIT risks.

- How do REITs work? How To Make Money On a REIT (Real Estate Investment Trust)?

- Comparison Between Direct Real Estate Investment vs REITs.

- Equity REIT Vs Mortgage REIT

- Risks of investing into Private REIT vs Public REIT

Popular

Benefits of the EB-5 Visa Program | Guide

Search within Paperfree.com