Value add real estate strategy helps investors drive capital growth

The value add real estate strategy's first goal is capital growth, the second goal is some income. The strategy works with all property typesFREE CONSULTATION

Investment Opportunities

Paperfree Marketplace Private Funds

Research News and Insights

- Value add real estate funds for capital growth | Paperfree.com

- Multifamily value add strategy to drive capital growth.

About value add strategy

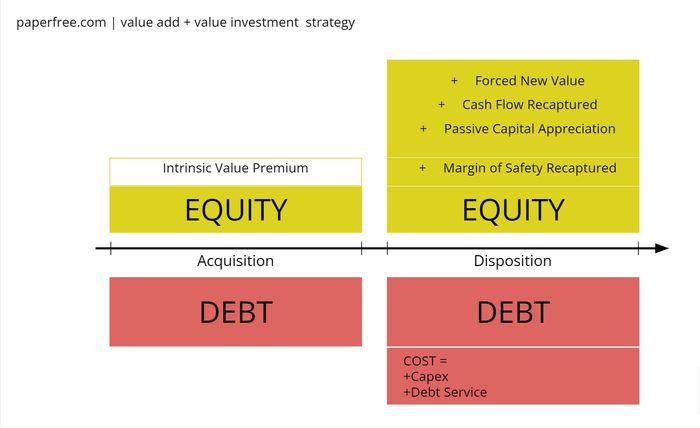

Investors who employ the value-add real estate investment strategy focus on purchasing properties that require renovation or improvement. They aim to resell it for a higher price after completing the necessary upgrades. Although this investment strategy can be profitable, it comes with several risks, including unfavorable shifts in real estate prices, rising interest rates, unforeseen property expenses, and potential legal liabilities that investors should be aware of.

Therefore, successful value add real estate investors must conduct meticulous research and acquire properties with significant upside value potential once repairs and renovations are complete.

Additionally, investors must have a detailed plan and an itemized budget for the improvements and other expenses before closing investment transactions. The plan must also include a strategy for selling the property after the improvements are made. The strategy's main goal is capital growth rather than income.

What is a value add real estate investment?

A value-add real estate investment conceptually is like a single-family house flipping project, except investors buy a value add asset at a discounted price and eventually sell the property when it's in much better condition.

The discounted price could stem from multiple sources:

- The property is distressed,

- needing significant repairs,

- or asset is underperforming financially, mostly underperforming cash flow.

While in the investors' possession, the property will undergo physical and operational improvements to enhance its value, which will impact the sales asking price. The investors aim to get a higher return on investment (ROI) through renovations, repositioning, and management changes.

Who is a value add real estate investor?

Value add investors are individuals who buy properties that have the potential to increase in value with improvements. Some popular property improvement options include new facades, overhauling operations, beautification, renovations, and rezoning land. By implementing improvements to the properties, value-add real estate investors seek to generate higher returns on their value add investments.

Value add real estate investing can reward investors with lucrative returns. However, since value-add real estate investors must opt-in with substantial capital, they must be people with strong risk tolerance and keen investor savvy.

Value add real estate strategy, how does it work?

A value-add real estate strategy is an investment approach that involves purchasing a distressed or underperforming property (value add property), making strategic renovations or improvements, and then selling or renting the property for a higher price. This strategy aims to increase the property's value and generate higher returns for investors.

Value-add real estate investments can take many forms, including:

- Increasing the property's income by leasing vacant space

- Changing the lease structure, ex., gross or N lease converts to NNN lease

- Increasing the property's income by raising rents

- Renovating a property to make it more attractive to tenants or buyers

- Repositioning a property by changing its use or rebranding it

- Adding amenities or upgrading technology to increase tenant retention

The performance or risks of a value-add strategy depend on many factors, some of which are:

- the local real estate market,

- the property's quality,

- the investors' skills and experience.

It is essential to conduct thorough due diligence before investing in a value-add property, whether actively or passively, and to have a clear plan for adding value and generating a return on investment.

What is a value add real estate?

From an investment standpoint, value-add real estate refers to an investment property that enables investors to enhance an asset's cash flow through renovations, rebranding, or operational efficiencies.

There are some attributes of value-add real estate investing in an asset that has one or a few attributes:

- physically outdated,

- has a lack of proper management,

- experiencing below-market rents,

- experiencing below-market occupancy rates.

Related [ value add real estate ] Content

- MVA2, Multifamily Value Add Fund by Paperfree.com

- Browse Real Estate Investment Strategies

- Real Estate Investment Strategies Guide by PaperFree

- Are mobile home a good investment? Why mobile home investing may be a good idea?

- Multifamily value add strategy to drive capital growth.

- Invest in Opportunistic Real Estate Strategy to maximize the potential for capital growth.

- Value add real estate funds for capital growth | Paperfree.com

Free Consultation