Consider a Core Real Estate strategy to maximize income with minimal risk.

Core Real Estate Strategy is one of the most conservative modern real estate investment strategies focusing primarily on income.FREE CONSULTATION

Investment Opportunities

Paperfree Marketplace Private Funds

Research News and Insights

What is Core Real Estate?

Core real estate refers to

- Class A real estate;

- located in high-quality locations;

- with top-notch tenants;

- and investors purchase these properties with less than 40% debt.

With these attributes, core properties have a relatively low-risk profile, like bond investments.

Core investments generally have a prominent anchor tenant (like Macy’s or Starbucks) and credit tenants on long-term leases. Similarly, multifamily core investments exist in desirable locations like Hyde Park in Tampa, Florida. In addition, as the term implies, core investments typically form the nucleus of the portfolios of commercial core real estate groups.

In short, core investment strategies include real estate strategies that have lower levels of leverage, longer hold periods and higher-quality assets.

What is Core Real Estate investment strategy?

The "Core" strategy is widely acknowledged as the safest option and bears similarity to fixed-income investments, such as bonds, in terms of risk and potential returns. This particular strategy is characterized by its lower leverage levels compared to other strategies, minimal modifications to the underlying asset, and stable and predictable cash flows. As such, it is considered a prudent investment choice for risk-averse investors seeking steady returns over a longer time horizon.

What are the benefits of Core Real Estate?

The core real estate investment strategy has the lowest risk profile and the most stable income compared to the other real estate asset classes. This safety feature is mainly due to the favorable leasing agreement structure with credit tenants. Credit tenants are tenants with stellar credit histories and rich financial resources. Since credit tenants sign lease terms of 10 to 30 years, the financial markets consider the rental payments as secure as bonds.

Real estate core investors can usually expect a moderate return of 6 to 10%, a decent return considering the low-risk factor. As a result, the core’s steady and consistent returns can offset the higher return of riskier asset classes during economic downturns.

Returns from core real estate investments are usually extremely passive because the properties require minimum improvements, and the renters expect minimum hands-on attention. In addition, since the properties are in ideal locations, a core real estate group can profit from long-term appreciation.

What are some examples of a Core Real Estate Investment?

A core real estate asset offers modest returns and carries no more than 45% debt to purchase the property. Also, most of the expected return typically comes from cash flow from the property instead of appreciation. Just as important, a core real estate investment must have the physical characteristics and capital structure for the long term.

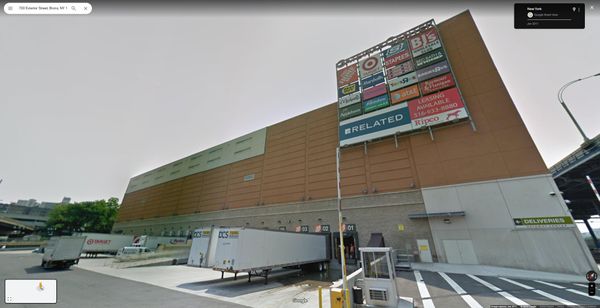

Considering these specs, an excellent example of a core real estate investment is a Target Store with a 30-year lease.

fig 1 . Core Real Estate Example. Target store at 700 Exterior Street, Bronx, NY 10451

Another fine example would be a large, fully leased office building in Miami, Florida. Core assets like these provide stable income and good potential returns from the sale of the properties.

fig 2. Core Real Estate Example. East Office Building in Miami, Florida

Free Consultation