Real estate investment strategies to grow and preserve wealth

Strategies across property types, capital stack, and risk profile.

QUICK LINKS

Real estate investment strategies can help both beginners and seasoned investors reap the rewards and build wealth through the power of real estate investing. Real estate investing strategies encompass a range of aspects, including financial analysis, evaluating potential investments, managing risks, understanding market conditions, and developing exit strategies to maximize returns.

Investing in real estate requires exploring numerous opportunities to choose the ideal strategy that achieves the desired financial goals. Achieving success in real estate investing requires established tactics, discipline, and commitment; however, achieving long-term wealth through smart investment decisions is possible with the right approach.

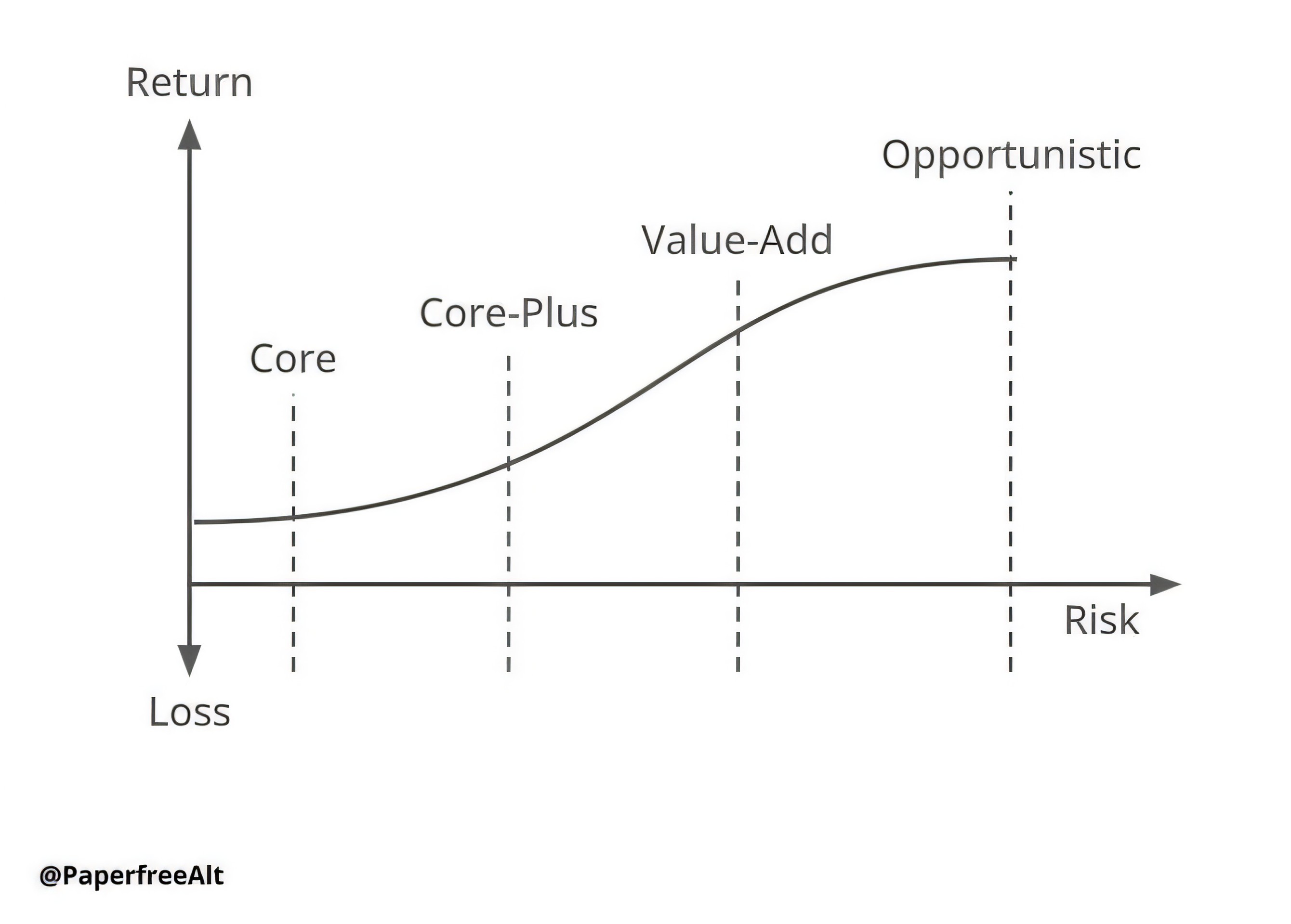

Real estate investment strategies across risk profiles.

|

Strategy Name |

Fixed Income Real Estate |

Core real estate investment strategy |

Core plus investment strategy real estate |

Value add real estate strategy |

Opportunistic investment strategy |

| Strategy Page | NA | CORE | CORE PLUS | VALUE ADD | opportunistic |

|

Strategy Goal |

Wealth Preservation |

Wealth Preservation |

Wealth Preservation and some wealth-building |

Wealth Building |

Wealth Building |

|

Description |

The strategy involved in debt financing. |

The strategy invests in fully leased properties with high-quality tenants. |

The strategy invests in properties needing minor controlled improvements or properties located in riskier markets. |

Value-add strategy investing in properties needing substantial controlled improvements. |

The opportunistic strategy involves major development. |

|

Example |

Mortgage. |

Office building in a major city downtown with long-term tenants. |

An office building with an 85% vacancy is in the secondary market. |

Multifamily property with 75% vacancy, requiring renovation. |

Ground-up multifamily developed project. |

|

Risk level and types |

Lower Risk. Market downturn. |

Lower Medium Risk. Low liquidity during a market downturn. |

Medium Risk Operational risks. |

High Medium Risk Operational risk. Vacancy during renovation. |

High Risk Financing. Market change. Permitting. Land entitlement. |

|

Return |

Dividend: 4-8% Total: 4-8% |

Dividend: 4-5% Total: 6-9% |

Dividend: 4-6% Total: 6-10% |

Dividend: 2-4% Total: 8-12% |

Dividend: 0-2% Total: 10%+ |

|

Related hashtags |

# low-risk real estate investing |

#low risk real estate investment strategies |

#low risk real estate investment strategies |

||

|

Investment opportunities |

Fig: risk-reward real estate investment strategies. Source: paperfree.com

Real estate investing tax strategies

- 1031 Exchange strategy, reinvestment in like-kind real estate

- 1031 Exchange DST, reinvestment in more passive real estate investments.

Strategies across property types

- Multifamily investing. Multifamily investment strategy for above-average returns.

- Investing in Senior Housing. Senior housing REITs are a growing market.

- Investing in Apartment Buildings

Invest across the capital stack

| Risk | Capital Stack Position | Strategy Page |

| High |

Private Equity Real Estate General Partner. |

real estate private equity |

| High Medium | Private Equity Real Estate Limited Partner. | NA |

| Medium | Private Debt Real Estate Mezzanine. | NA |

| Low | Private Debt Real Estate Senior Loan. | NA |

What is the best real estate investment strategy?

No one strategy fits all. It is very individual.

Each investment strategy has unique attributes:

- potential return,

- terms,

- risks,

- taxes,

- other intangible benefits and losses (reputation, time, etc.)

The most critical attribute for most investors is risk. Understanding all the risks of a specific investment strategy you are vetting is crucial. After strategy risk assessment, the next step is to align it with the risk margin of your capital. And decide to pass on the opportunity or move to deeper due diligence.

Example approach:

- The Fixed Income Strategy is the most conservative strategy, characterized by the lowest risk. A fixed-income strategy may be a suitable choice for a well-diversified investment portfolio when an investor seeks stability.

- The Opportunistic Strategy has the highest risk. The opportunistic strategy is a good fit for the fresh portfolio, which has time to recover from potential losses associated with high-risk investments.

- There are strategies between Core, Core Plus, and Value Add strategies, with a medium risk of potential capital loss.

Investment industry veterans suggest designing and running a personalized investment strategy, empowered by diverse strategies; this would be a mix of different real estate strategies, the more the better.

Example, portfolio design:

20% of the total portfolio is allocated to alternative Investments, where 20% is split:

- 30% of 20% to Core real estate investment,

- 30% of 20% to Value Add real estate investment,

- 10% of 20% to Opportunistic real estate investment,

- 30% of 20% to other Alternatives.

The Real Estate Investment portfolio is split between a few real estate investment strategies:

- 40% Core Strategy,

- 30% Value Add,

- 30% Fixed Income,

- 10% Opportunistic Strategy.

Book a Free Complimentary Call

real estate investing Investment Visa USA Investment Magazine Private Real Estate Funds real estate funds